It might seem like a strange idea but buried in an old piece of legislation designed to help coal miners is a magical key which can potentially open the ownership door for millions of new homebuyers. The idea is called “shared equity” and there’s reason to think that its time has come.

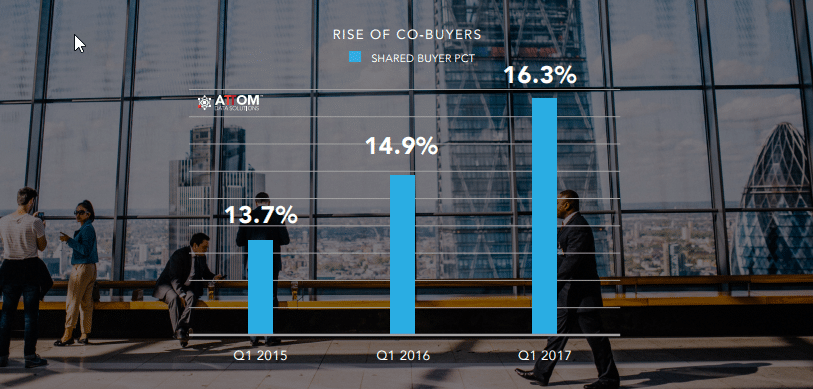

More than 16 percent of all single family purchases in the first quarter of 2017 were to co-buyers — multiple, non-married buyers listed on the sales deed — up from less than 15 percent in Q1 2016 and up from less than 14 percent in Q1 2015, according to ATTOM Data Solutions. For a detailed home sales data analysis, click here.

A similar trajectory can be seen in the share of co-borrowers — multiple, non-married borrowers listed on the purchase mortgage or deed of trust — which accounted for 22 percent of all single family purchase loan originations in Q1 2017, up from 20 percent in Q1 2016.

Why Now?

Millions of potential real estate buyers today linger on the sidelines, unable and often unwilling to purchase a home of their own. Despite remarkably low mortgage rates, ownership levels are

Brian Bailey, the Co-Founder and COO with California-based OWN home finance, p.b.c., estimates that the shared equity market is now around $500 million in originated assets, and growing.

Bailey explains that shared equity “is becoming more legitimized as people begin to realize the value of deleveraging the home purchase. We’ve already seen great demand for shared equity, and as the capital markets increase support for the transaction, funding sources will become more available — growing the market even more for shared equity.”

How Shared Equity Works

What does it take to create a shared equity agreement? Here are the basics:

There must be a written shared equity agreement. This agreement must show the ownership percentage of each party as well as a number of specifics such as whether a partnership is being created, how title will be held (generally as tenants-in-common), how expenses will be allocated, what happens if one party wants to sell but not the other, and how title is handled in the event of marriage, divorce, or death. Importantly, ownership percentages are negotiable, there is no set or required arrangement.

More on how shared equity agreements work.

Co-Funding Alternatives

While financing shared equity purchases is possible with traditional loan programs, the out-of-the-box nature of buyers in need of equity sharing can make traditional financing a challenge. In response, a growing number of companies — most of them startups — are offering a new breed of equity sharing programs tailored specifically to these out-of-the-box buyers.

Jim Riccitelli, Co-CEO of San Francisco-based Unison Home Ownership Investors, said his company offers programs in more than a dozen states for both purchasers and existing owners. With Unison the resident owner alone is on the title and the company obtains a profit or loss only when the owner elects to sell, an ownership term which can last as long as 30 years.

“Unison provides long-term investment capital to homeowners,” Riccitelli explained. “The client can use the capital for up to 30 years. Unlike debt-based programs, such as mortgages and home equity loans, there are no interest charges or monthly payments. Instead, Unison’s investors earn a return by sharing in the change in value of the home, up or down, when the homeowner decides to sell — up to 30 years later. As partners, we win or lose together. If the home value rises, the homeowner and the investor both profit. If the home value falls, both lose.”

Riccitelli said his program can significantly change ownership economics by helping buyers qualify more easily for mortgage financing.

“Our Unison HomeBuyer program can double a buyer’s down payment cash, which can eliminate the need for costly mortgage insurance and significantly lower the monthly mortgage payment (typically by 15-20 percent),” he said. “This monthly payment savings can make it far easier to income-qualify for a mortgage loan.”

Bailey, OWN home finance, p.b.c.’s Co-Founder and COO, said that “shared equity helps ease some of the most significant barriers to homeownership bringing a new capital source to the table to overcome down payment requirements and deleveraging the home purchase.”

Bailey noted that his company’s shared equity program helps improve the credit profile of a borrower. He provided the example of a mortgage with a 95 percent loan-to-value (LTV) and a 43 percent debt-to-income (DTI) ratio and 33 percent payment-to-income (PTI) ratio that with the help of an equity sharing agreement could look more like an 80 percent LTV with a 38 percent DTI and 28 percent PTI.

Co-Buying

Seattle-based CoBuy does not act as a brokerage or as an investor owner. Instead, said Co-Founder Pam Hughes, the “platform helps would-be co-buyers determine pre-eligibility, build consensus and get connected with vetted professionals in the real estate value chain.” Professionals can include lenders, real estate brokers, title/escrow agents, real estate attorneys, CPAs and insurance brokers.

Shared equity, said Hughes, “is an ideal way to ‘repurpose’ the large family home that the boomers own to enable younger generations to share in the benefits of ownership with people they know, love and trust. This helps the next generation build credit and provides an easy entry into homeownership.”