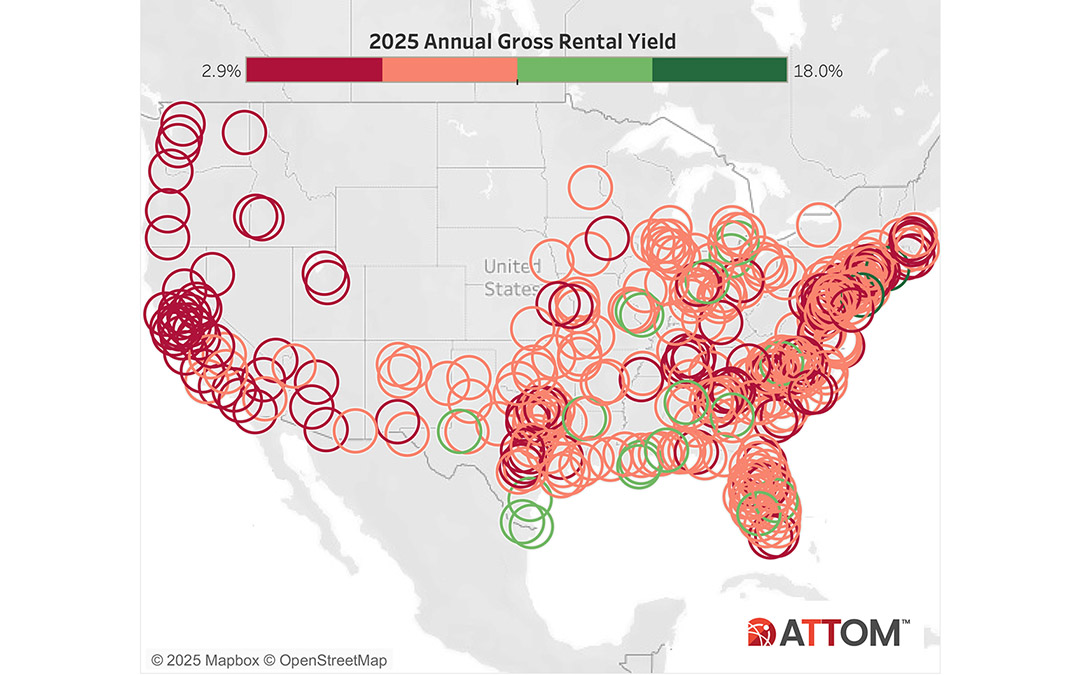

As the housing market continues to evolve, investors are increasingly eyeing single-family rentals (SFRs) for reliable returns — and new data from ATTOM reveals where the best opportunities lie in 2025.

According to ATTOM’s Q1 2025 Single-Family Rental Market report, areas like New York City, Atlantic City, Birmingham, Mobile, and Odessa top the list for highest potential returns. The report analyzed 361 U.S. counties with reliable rent and price data, calculating gross rental yields based on median home prices and median rents for three-bedroom homes.

Where Returns Are Strongest

Suffolk County, NY — part of the New York City metro — leads the nation with a projected gross rental yield of 18% in 2025. Other high-performing counties include Atlantic County, NJ (16.8%), Jefferson County, AL (13.6%), Mobile County, AL (12.9%), and Ector County, TX (12.5%).

Counties with large urban populations also performed well. Among those with over 1 million residents, top yielders include Wayne County, MI (Detroit) at 10.9%, Cuyahoga County, OH (Cleveland) at 10.1%, and Cook County, IL (Chicago) at 9.2%.

Yields Down as Prices Outpace Rents

Despite strong showings in certain regions, ATTOM’s data also shows that rental yields are trending downward in 57% of analyzed counties. Rising home prices — outpacing rent growth in over half the markets — are squeezing margins for investors. In areas like Litchfield County, CT, and Monroe County, NY, yields have dropped more than 3 percentage points year-over-year.

“Longtime landlords are benefiting from rising property values pushing rents higher,” said Rob Barber, CEO of ATTOM. “But new investors face increasing challenges as acquisition costs climb.”

Western Markets Show Lowest Returns

On the opposite end, Western metro areas continue to struggle with low rental yields. Santa Clara County, CA (San Jose) posted the nation’s lowest projected yield at just 2.9%, followed by San Mateo County, CA (3.3%) and Williamson County, TN (3.4%).

Tracking Growth Markets

Despite headwinds, ATTOM identified 28 counties that offer a promising combination of high rental yields and rising wages — suggesting ongoing potential for SFR growth. These include Wayne County, MI (Detroit); Cuyahoga County, OH (Cleveland); Shelby County, TN (Memphis); and Suffolk County, NY.

With affordability still a pressing issue nationwide, single-family rentals remain a critical piece of the housing puzzle — and a strategic opportunity for investors.

Access the full report here. To get the data behind the story, please contact one of our data experts.