ATTOM released its Year-End 2022 U.S. Foreclosure Market Report, which shows foreclosure filings— default notices, scheduled auctions and bank repossessions — were reported on 324,237 U.S. properties in 2022, up 115 percent from 2021 but down 34 percent from 2019, before the pandemic shook up the market. Foreclosure filings in 2022 were also down 89 percent from a peak of nearly 2.9 million in 2010.

Those 324,237 properties with foreclosure filings in 2022 represented 0.23 percent of all U.S. housing units, up slightly from 0.11 percent in 2021, but down from 0.36 percent in 2019 and down from a peak of 2.23 percent in 2010.

ATTOM’s year-end foreclosure report provides a unique count of properties with a foreclosure filing during the year based on publicly recorded and published foreclosure filings collected in more than 3,000 counties nationwide, accounting for more than 99 percent of the U.S. population – also available for license or customized reporting. See full methodology below.

The report also includes new data for December 2022, showing there were 30,822 U.S. properties with foreclosure filings, up less than 1 percent from the previous month but up 72 percent from a year ago.

Bank repossessions decrease 70 percent since 2019

Lenders repossessed 42,854 properties through foreclosures (REO) in 2022, up 67 percent from 2021 but down 70 percent from 2019 (143,955) and down 96 percent from a peak of 1,050,500 in 2010.

States that saw the greatest number of REOs in 2022 included Illinois (5,518 REOs); Michigan (3,669 REOs); Pennsylvania (2,741 REOs); New York (2,405 REOs); and California (2,223 REOs).

Foreclosure starts on the rise nationwide

Lenders started the foreclosure process on 248,170 U.S. properties in 2022, up 169 percent from 2021 but down 26 percent form 2019 and down 88 percent from a peak of 2,139,005 in 2009.

States that saw the greatest number of foreclosure starts in 2022 included California (27,269 foreclosure starts); Texas (23,151 foreclosure starts); Florida (22,968 foreclosure starts); Illinois (16,941 foreclosure starts); and Ohio (13,469 foreclosure starts);

Illinois, New Jersey and Delaware post highest state foreclosure rates in 2022

States with the highest foreclosure rates in 2022 were Illinois (0.49 percent of housing units with a foreclosure filing); New Jersey (0.45 percent); Delaware (0.40 percent); Ohio (0.38 percent); and South Carolina (0.37 percent).

Rounding out the top 10 states with the highest foreclosure rates in 2022, were Nevada (0.34 percent); Florida (0.33 percent); Indiana (0.30 percent); Maryland (0.27 percent); and Michigan (0.26 percent).

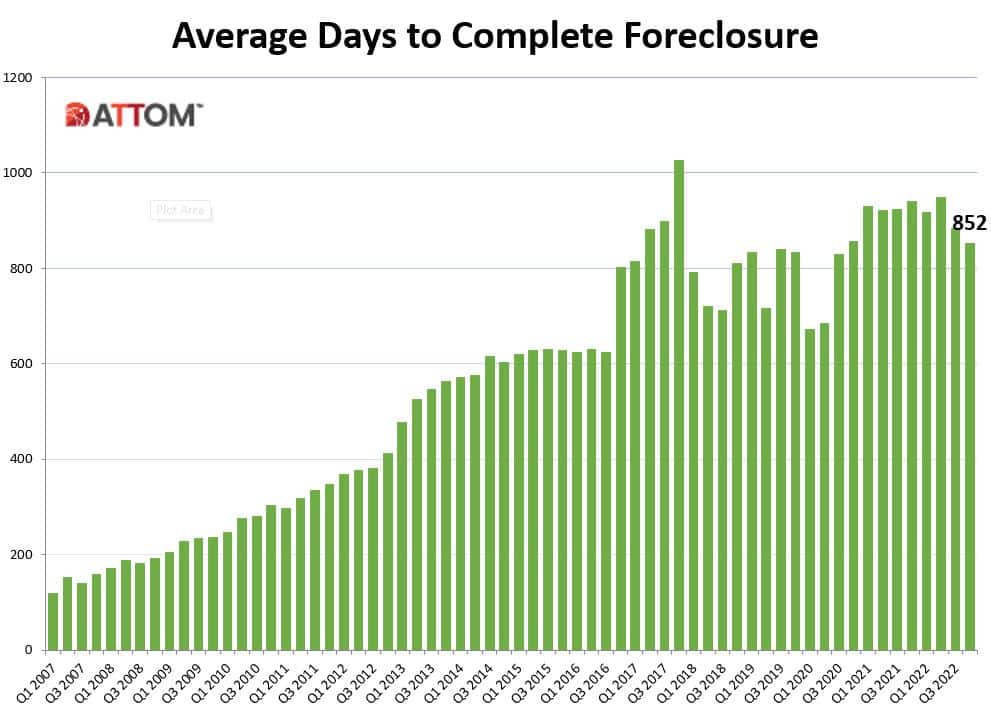

Average time to foreclose decreases quarterly and annually

U.S. properties foreclosed in the fourth quarter of 2022 had been in the foreclosure process an average of 852 days, a 4 percent decrease from the previous quarter and 9 percent decrease from a year ago.

Access the full report here. To get the data behind the story, please contact one of our data experts.