Written by Leonard Kiefer, PhD Deputy Chief Economist with Freddie Mac

February 15, 2023

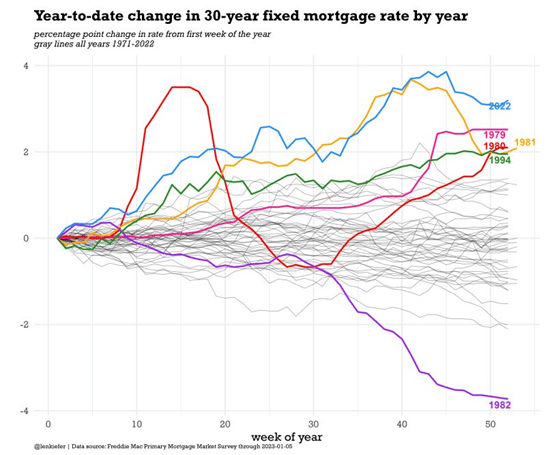

This past year has been a tough one for U.S. housing and mortgage markets. After reaching historically low interest rates in early 2021, mortgage rates entered 2022 around 3 percent for the 30-year fixed-rate mortgage. By historical standards a 3 percent mortgage rate is still quite low. However, throughout 2022 as concerns about persistently high inflation led to a successive round of interest rate hikes by the Federal Reserve Open Market Committee, mortgage rates increased rapidly, reaching over 7 percent by November 2022. Rates eased a bit, but ended the year at 6.42, which was the highest rates had ended a year since 2001.

In many ways the increase in mortgage rates in 2022 was unprecedented. The closest analog to 2022 was 1981 when rates increased 3 percentage points during the calendar year, but rates were starting from a much higher level, from around 13 percent at the start of the year. In 2022 mortgage rates more than doubled.

The impact of higher rates on the U.S. housing market was swift. Mortgage refinance activity was the first segment to respond. As rates increased in spring 2022, the number of mortgages “in-the-money” for a mortgage refinance nearly vanished and the volume of new mortgage refinance applications plummeted. Since homeowners had gained so much equity over the past two years, there was still some demand for refinancing due to cash-out but as rates pushed past 6 percent the volume of cash-out refinances dwindled as well.

Next came a contraction in home sales. Higher mortgage rates dramatically reduced the ability of prospective homebuyers to afford homes. For example, the monthly principal and interest on a hypothetical 30-year fixed-rate mortgage of $300,000 is $1,265 a month at a 3% rate but increases to $1,996 at 7%. That’s over $700 more a month in principal and interest payments. Many prospective buyers just can’t afford that much extra cash. The result was a sharp contraction in home buying.

According to the National Association of Realtors, the total number of existing home sales in the U.S. in November of 2022 was 4.09 million, down 35.4% from 6.33 million in November of 2021. Given trends in home purchase mortgage applications, existing home sales are likely to continue contracting into the first quarter of 2023.

Finally, we come to home prices. In a typical housing cycle, quantities contract first and only later do prices start to soften. Indeed, while price growth remained robust through spring of 2022, price growth slowed rapidly through the summer and by fall prices lost momentum. Measuring home price growth during periods of rapid changes is extremely difficult, but according to the latest monthly data available from the FHFA, house prices were unchanged between September and October of 2022 on a seasonally adjusted basis. And, alternative measures, such as the S&P CoreLogic Case-Shiller home price index for the U.S. reported negative monthly growth in the fall of 2022.

That said, where will the housing market go in 2023?

We’re not likely to have a good reading on where things might be headed until we get into the spring homebuying season. As the market reaches its seasonal nadir in January and February, housing market participants, both potential buyers and sellers are going to have to reassess. Here are some of the factors potential homebuyers and sellers will have to consider.

- Many homeowners have locked in low mortgage rates

Many homeowners have locked in low mortgage rates. According to data from the National Mortgage Database (NMDB) over 60 percent of outstanding U.S. mortgages had an interest rate of 4 percentage points or less. We saw evidence of the effect of mortgage rate lock-in by the reduction in new home listings throughout 2022. According to data from Redfin, new for-sale home listings in December 2022 were down over 20 percent from a year earlier. Mortgage rate lock-in removes some potential inventory from the market and helps balance out the reduction in demand due to higher rates.

- Current homeowners have substantial equity

Even with a modest decline in house prices (5-10%), most U.S. homeowners will maintain substantial equity. Since the end of 2019, house prices have increased over 40 percent, and aggregate homeowner equity has increased about $10 trillion. That equity provides a significant buffer for households to absorb modest price declines without falling into negative equity, which is traditionally viewed as one of the triggers of mortgage default (along with an income or employment shock).

- The labor market remains strong

If the labor market continues to remain strong, there is unlikely to be a surge in forced selling. The U.S. economy added over 4.5 million payroll jobs in 2022, a record for job growth only surpassed in 2021. And, while the pace of job growth decelerated at the end of 2022, the unemployment rate was 3.5 percent in December 2022.

- First-time homebuyers continue to drive the market

Despite the substantial affordability challenges posed by higher mortgage rates and elevated house prices, there remains a sizable demographic tailwind to the housing market from first-time homebuyers. According to the NMDB, over half of all home purchase mortgages in 2021 went to first-time homebuyers and analysis of Freddie Mac data indicates that trend continued throughout 2022. According to research from my colleagues at Freddie Mac even at a seven percent mortgage rate there are 12 million mortgage-ready potential homebuyers who have the capacity to afford a $400,000 loan but have not yet purchased.

- Overall housing supply remains well short of long-run demand

Despite increases in construction activity in 2022, the U.S. housing market still has a persistent shortfall of available supply. According to research from my team at Freddie Mac, the U.S. housing market was 3.8 million housing units undersupplied as of 2020. Increases in construction have helped to fill some of that gap, but not all of it. The shortage of housing keeps pressure on both the home sales and rental markets, keeps vacancy rates low and offers a conduit to absorb any homes that might work through the foreclosure or distressed sales pipeline.

Considering all these factors, I believe there is reason for cautious optimism about the U.S. housing market in 2023. Certainly, if mortgage interest rates were to spike again, or the economy were to enter a recession, the outlook would dim. But, in a baseline economic scenario where inflation slows in 2023, interest rates stabilize or even modestly decline and the economy avoids a sharp increase in unemployment, the housing market should balance out.

In this most likely scenario, home sales transactions stabilize in the second quarter of 2023 and remain at a low level but do not fall further. House prices decline modestly in this scenario, but the buffer provided by substantial equity and mortgage rate lock-in prevent fire sales and mass forced selling. Mortgage activity balances out with very limited refinances and home purchases following home sales.

While this would not be by any stretch a stellar year, it would put the housing market on pace for a strong rebound in 2024 and beyond.