U.S. Homeowner Equity Surges in Q2 2024 as Property Values Rise, Underwater Mortgages Hit Five-Year Low

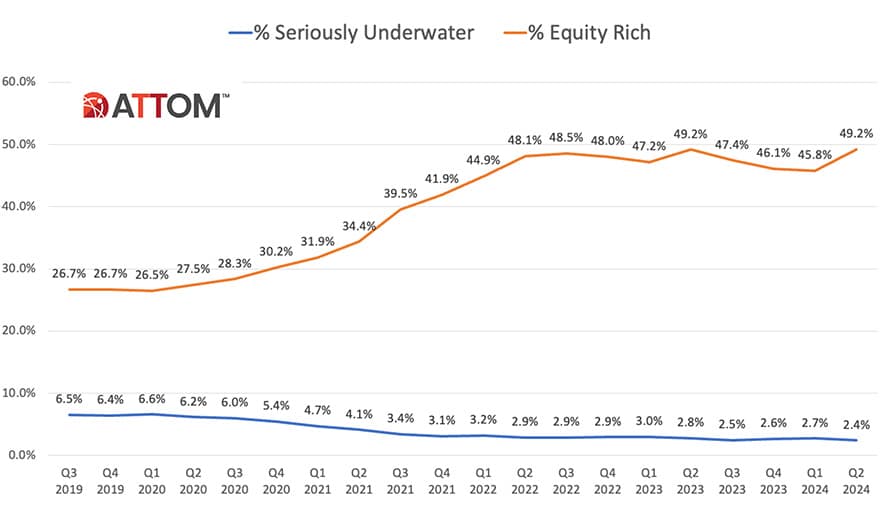

In the second quarter of 2024, ATTOM, published its Q2 2024 Home Equity and Underwater report highlighting a rebound in homeowner equity across the country. According to the report, nearly half (49.2%) of U.S. mortgaged homes are now considered equity-rich, meaning their loan balances are less than half of their estimated market values. This represents an increase from 45.8% in the first quarter, reversing a previous decline and marking one of the largest equity gains in the past five years.

The rise in home equity is largely attributed to a spike in home prices during the spring buying season, which saw the median national price increase by 9%. As home values surged, many homeowners saw a boost in their equity, helping to elevate wealth levels across the country. Simultaneously, the portion of mortgages that were seriously underwater—where loan balances exceed the home’s value by 25% or more—dropped to 2.4%, the lowest rate in five years.

ATTOM’s CEO, Rob Barber, noted that this turnaround in homeowner wealth comes after a period of stagnation in the housing market, driven by limited home supply and strong buyer demand. Stable mortgage rates and a robust job market also played key roles in pushing home values higher.

Equity-rich mortgages saw increases across 48 U.S. states, with the biggest gains occurring in more affordable markets in the South and Midwest, including Kentucky, Illinois, and Missouri. Conversely, the lowest levels of equity-rich homes were found in states like Louisiana and Alaska.

As for seriously underwater properties, the decline was widespread, with only two states—Utah and South Dakota—showing slight increases. The largest reductions in underwater mortgages were seen in Wyoming, Kentucky, and Illinois.

Despite these national trends, the highest levels of equity-rich homes remained concentrated in higher-priced regions like the Northeast and West, with states like Vermont and Maine leading the way. In contrast, lower-priced markets in the South and Midwest, including Louisiana and Arkansas, had the smallest shares of equity-rich homeowners.

The report underscores the ongoing influence of rising home values in increasing homeowner equity, while the portion of underwater mortgages continues to shrink, further solidifying the financial position of many U.S. homeowners.

To learn more and access more detailed data or get the data behind the stories, contact one of ATTOM’s data experts.