Despite a dip in effective property tax rates, U.S. homeowners paid more in property taxes in 2024 than the year before, according to ATTOM’s annual property tax analysis. The report, which covers 85.7 million single-family homes, found that the average property tax bill increased by 2.7%, rising to $4,172.

At the same time, the average effective tax rate — the percentage of a home’s market value paid annually in property taxes — fell slightly from 0.87% in 2023 to 0.86% in 2024.

The trend reflects the broader housing market rebound, with average U.S. home values climbing 4.8% to $486,456 after dipping the previous year. This rise in values helped suppress tax rates, even as overall tax bills crept upward.

Regional Disparities Remain Strong

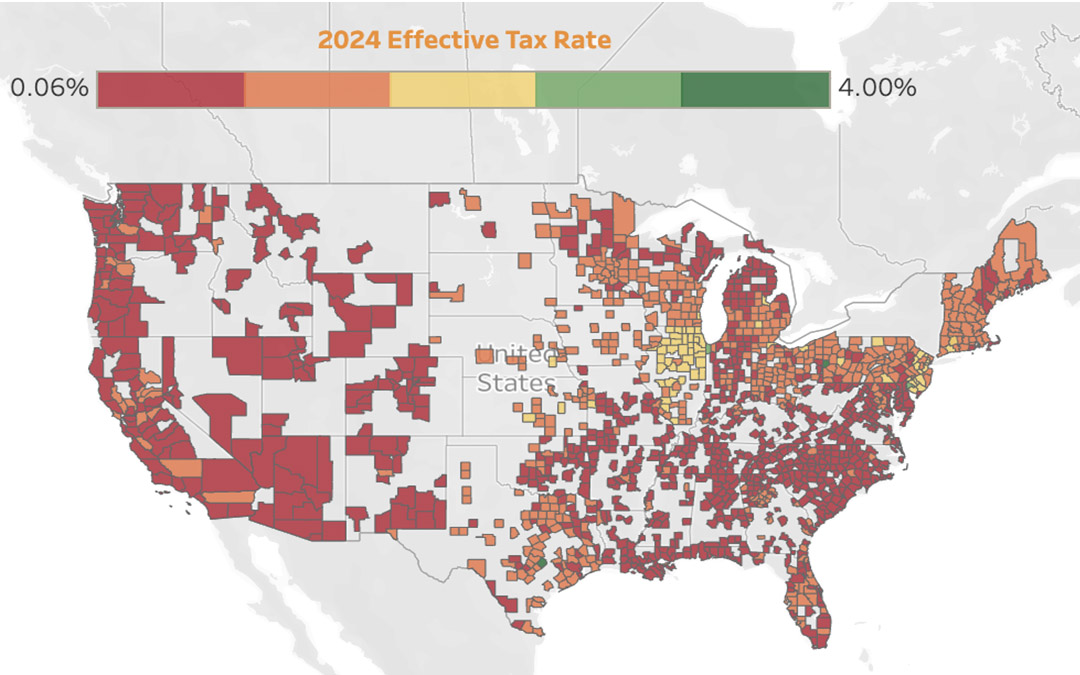

Northeastern and Midwestern states continue to carry the heaviest tax burdens. Illinois led the nation in effective tax rate at 1.87%, followed by New Jersey (1.59%), and Connecticut (1.48%). Meanwhile, New Jersey also had the highest average tax bill at $10,135 — nearly 10 times that of West Virginia, which had the lowest average at just $1,027.

In contrast, states in the South and West saw the lowest effective tax rates, with Hawaii (0.33%), Idaho, Arizona, and Alabama all at or near 0.41%.

Metro-Level Highlights

At the metro level, the Midwest dominated with 16 of the 25 highest effective tax rates located in that region. Cities like Rockford and Chicago, IL led the list, while areas with the lowest rates included Salisbury, MD and Honolulu, HI.

Among larger metros with populations over 1 million, Chicago (1.91%), Cleveland (1.65%), and Hartford, CT (1.71%) topped effective tax rates. On the low end were Phoenix (0.37%), Las Vegas (0.48%), and Salt Lake City (0.48%).

Bigger Bills in Growing Markets

In 2024, 157 metro areas experienced tax bill increases above the national average of 3%, with Raleigh, NC (21.1%), Honolulu, HI (17.2%), and Chicago, IL (12.9%) seeing the biggest spikes.

Notably, 19 U.S. counties reported average property tax bills exceeding $10,000, with Bastrop County, TX topping the list at $28,297, followed by Marin County, CA ($15,881).

Behind the Numbers

According to ATTOM CEO Rob Barber, the rise in tax bills reflects not just higher property values but also increased local government spending. “Rising home values don’t automatically mean higher property taxes,” he said. “But in many areas, growing operating costs for schools and municipal services are shifting more tax burden onto homeowners.”

As values continue to climb and mortgage rates remain elevated, local tax policies will play an increasing role in the affordability equation for American homeowners.

Access the full report here. To get the data behind the story, please contact one of our data experts.