The past decade has been great for the housing market with rising prices, low mortgage rates, and strong sales. But now – with half of 2022 over and done – it’s hard to ignore the lagging home sales, soaring interest rates, and bloated inflation levels. The comfy certainty of the past decade is at an end, but what will the new market look like?

The Case for a Real Estate Crash

There’s no shortage of online articles and opinions suggesting that we’re about to have a massive real estate crash. After all, we did have a crash as a result of the mortgage meltdown, such things are possible.

If we’re headed for a crash there should be some hint of things to come, say lots of evictions and foreclosures. In March 2021, the Consumer Financial Protection Bureau (CFPB) unleashed a fearsome forecast, saying “11 million renter and homeowner households were significantly overdue on their regular housing payments as of December 2020, placing them at heightened risk of losing their homes to foreclosure or eviction over the coming months.”

The “coming months” have surely passed. Where’s the real estate carnage?

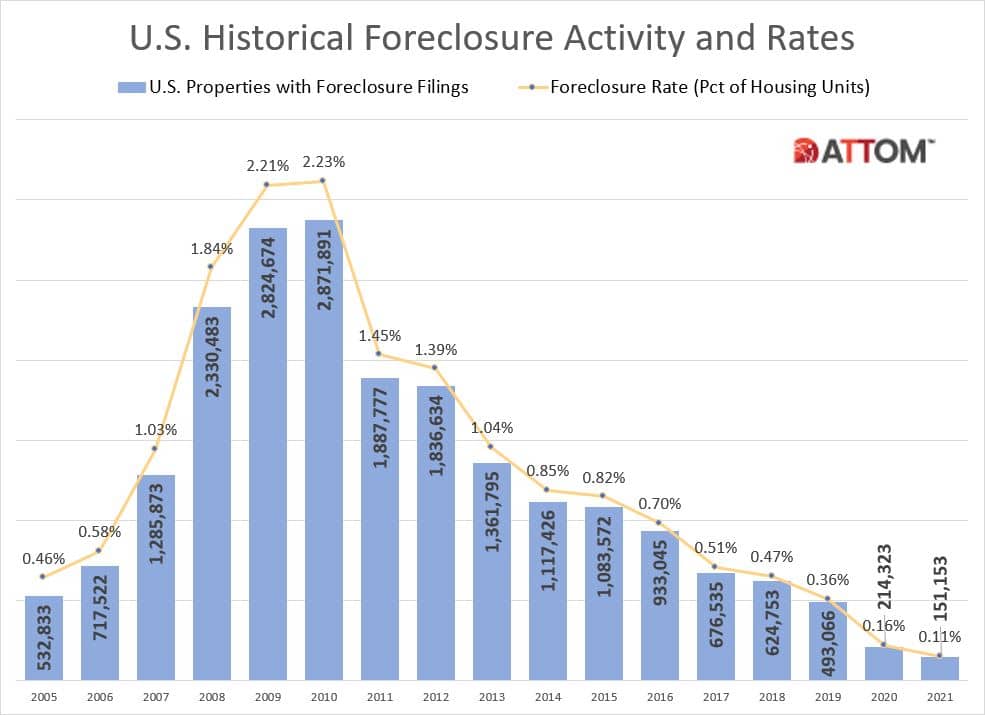

Consider foreclosures. Figures from ATTOM’s foreclosure market report show that in May there were 30,881 foreclosure filings — default notices, scheduled auctions or bank repossessions. That’s up 185% over last year.

Nearly 31,000 distressed homes in May is a number that stands out, but the country has a lot of houses. According to the Census Bureau, there were 83.4 million owner-occupied homes at the end of the first quarter. Of this number, 37.9% — 31.6 million – are owned free and clear of any mortgage debt.

Many if not most distressed owners will never see their properties sold on the courthouse steps. Home prices are rising so quickly – up 14.8% in April when compared with a year ago, according to the National Association of Realtors (NAR) – that most can quickly sell for full market value and avoid foreclosure.

A second reality is that the May percentage increase is high, not because of massive foreclosure or eviction activity, but because a year ago federal eviction and foreclosure moratoriums were in full force.

“Despite scary headlines and worrisome predictions, to this point the housing market has done very well,” said Rick Sharga, executive vice president of market intelligence at ATTOM Data Solutions. “That said, there are hurdles ahead, reason to believe we’re moving toward a softer market. A 14.8% annual price gain is neither normal nor sustainable.”

Mortgage affordability

The looming problem is affordability. Combine soaring prices, limited inventory, and quickly rising rates, and it’s a financial triple-whammy many buyers cannot overcome. The Mortgage Bankers Association (MBA) calculates that monthly payments for principal and interest increased $514 between January and May, a 37% jump. The result, says the MBA’s Edward Seiler, is that in 2022 sales of “new and existing homes will fall below 2021 levels.”

Existing sale levels are already down by more than a million units. In January, NAR said sales were moving along at almost 6.5 million units per year, a rate that fell to 5.4 million by May.

And yet, even with fewer sales and less demand, existing home prices are up. The typical May home price reached $407,600, according to NAR. This represented “123 consecutive months of year-over-year increases, the longest-running streak on record.”

Real estate moderation vs a crash

Slower sales are plainly here, but what about real estate pricing? How can prices keep going up, and is that likely to continue much longer?

Redfin reported that in May, “more than 10% of home sellers dropped their price in all 108 metros, driving the national share of price drops to a record high.”

The catch is that there’s a difference between “asking prices” and sale values. Home prices during the initial months of 2022 consistently went up despite higher mortgage rates, and almost 90% of home sellers did not cut their asking prices. Plus, bidding wars are still with us. Redfin reported that, in May, 57.8% of the home offers written by its agents faced competition.

Market stability

There’s no question that real estate demand slowed during the first half of the year. We saw fewer bidding wars, quickly-rising interest rates, reduced sales, and less-aggressive asking prices.

Does this mean falling home values loom ahead in most markets? Equally important, will we soon see another flood of foreclosures and evictions — as we did in 2008, 2009, and 2010 — that will drive down prices in general?

The likely answer is a marketplace slide rather than an outright crash, with most metro areas doing fairly well but some facing actual sale price declines. Here’s why.

First, most homeowners can readily wait out any downturn and not be forced to sell because of rising monthly mortgage costs. Low rates, fixed rates, and federal requirements that lenders verify the ability of borrowers to repay their mortgages all contribute to a safe and steady marketplace.

Stephen Kim and Trey Morrish, analysts with Evercore ISI, a global independent investment bank, pointed out in May that “over the past few years, millions of borrowers got a helping hand from the Fed and refinanced their loans to super-low-rate, 30-yr fixed mortgages. Over 95% of all outstanding mortgages have fixed terms, and the median rate is <3.4%.”

They added that “this year, as affordability gets stretched, the ARM share of new originations will rise, but the overwhelming majority of existing home owners have locked in many years of extremely low mortgage payments. Thus, while home price growth may slow this year, the risk of foreclosures – and the kind of home price collapse the stocks have priced in – is minimal.”

Second, a fall in pandemic appreciation levels is overdue. That’s because the price growth seen in 2021 and so far in 2022 is simply unsustainable. Even if recent appreciation levels are cut in half, solid annual growth is still possible.

Third, unlike the mortgage meltdown – when $700 billion was set aside to save the banking system – financial institutions this time around are showing impressive profits – $59.7 billion in just the first quarter.

Fourth, there’s little inventory relief in sight from new construction. Despite obvious demand, government figures show May new home sales were 5.9% below a year ago and the industry had 434,000 job openings. As to existing homes, many owners are sitting tight, not wanting to give up financing at or near historically-low mortgage rates. One growing source of housing supply: The increasing development and acceptance of accessory dwelling units (ADUs) in many jurisdictions, the division of one property into several residences.

Fifth, we need to ask what happens if real estate values fall. For most homeowners it means a smaller balance sheet, less ability to borrow, and a lower sale value– results that are not real problems unless you’re refinancing or selling, something most owners are simply not doing.

So far in 2022 – and despite rising mortgage rates and fewer sales – NAR reports that existing home prices typically increased from $354,300 in January to $407,600 in May, a huge jump. Alternatively, in the first half of 2022, the Dow Jones Industrial Average was off 15.88%, the Nasdaq Composite was down 30.34%, the S&P 500 dropped 21.08%, and – hold on to your retirement plans – the S&P Cryptocurrency Broad Digital Market Index was down 64.32%.

As Wall Street reminds us, past performance does not guarantee future results – but we do know that most homeowners locked-in ultra-low long-term rates, relatively few financed with ARMs, millions of homes are mortgage-free, the banks are doing well, and toxic financing is a thing of the past. In the first quarter, NAR said existing home values in 185 major metro areas generally increased 15.7% during the past year, but also that values fell in several — Cape Girardeau, MO-IL (-2), Rockford, IL (-1%), and Topeka, KS (-1.9%).

The bottom line: Will there be a widespread return to pre-pandemic pricing levels, the values we saw in 2019? That would surely be seen as a crash by many, but such a result also seems unlikely in an economy with full employment, big savings, little real estate supply, and lots of unmet demand.