By Mike Simonsen, Chief Economist, Compass

For years, the housing market narrative has focused on what’s missing: not enough inventory, not enough sellers, not enough transactions. But after working through the data for our 2026 Housing Market Outlook at Compass, I’ve started to see something that may be hiding in plain sight. There appears to be a meaningful reservoir of demand waiting for the right moment to activate.

The evidence shows up in several places once you start looking.

The Withdrawal Paradox

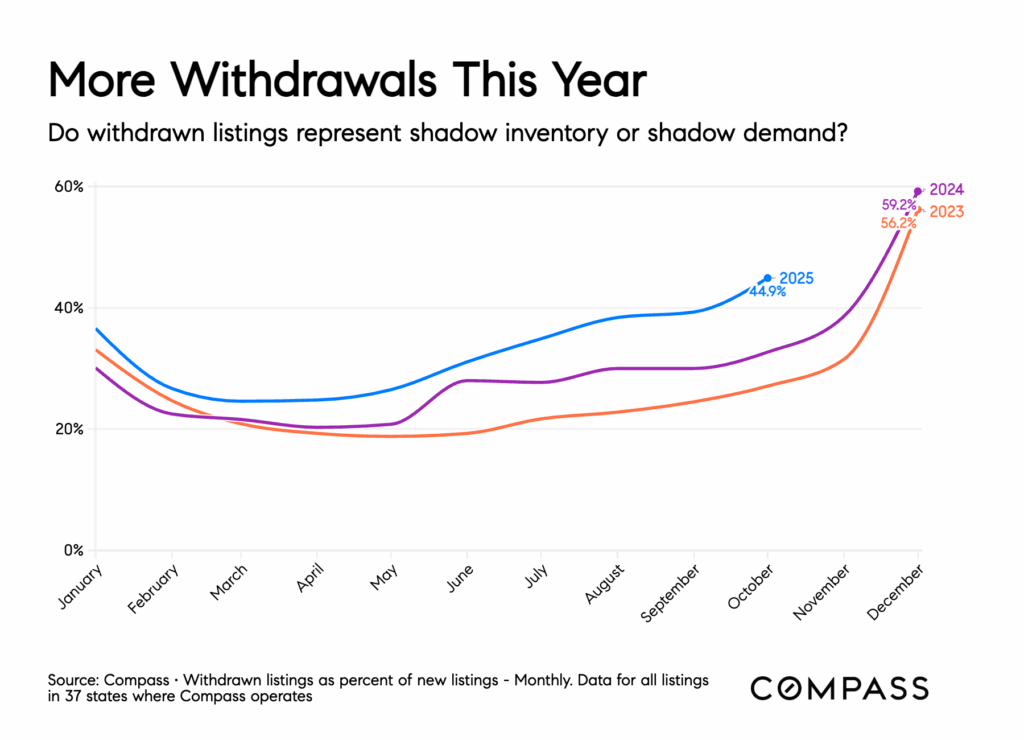

Consider listing withdrawals: homeowners who put their properties on the market, then pulled them back without selling. In 2025, withdrawals climbed to nearly 45% of new listings, the highest ratio in recent history. Compass counts over 150,000 more withdrawals than in 2024 through mid-November.

At first glance, this looks like shadow inventory, meaning sellers who want to move but can’t find buyers. The conventional wisdom says this overhang threatens future prices. But when I looked closer at who’s actually withdrawing, the picture shifted.

Most of these withdrawn listings don’t appear to be investors liquidating rental portfolios. They look like owner-occupants, families who need to sell their current home to buy their next one. And here’s what struck me: for owner-occupiers, every withdrawn listing may represent two delayed transactions, not one. A sale and a purchase, both pushed from 2025 into 2026.

If this interpretation is correct, we’re not looking at shadow inventory. We’re looking at shadow demand.

The Application Gap

Purchase mortgage applications tell a similar story. Throughout 2025, the Mortgage Bankers Association’s Purchase Applications Index has run 15-25% higher than the prior year. Yet actual closed sales rose only 2-4%. That gap, applications up meaningfully while closings inch forward, suggests a population of Americans who started the homebuying process but didn’t finish it.

These aren’t casual browsers. Getting pre-approved for a mortgage takes effort. These appear to be serious buyers who ran the numbers, assembled their paperwork, and then paused. Maybe rates ticked up at the wrong moment. Maybe the right house didn’t materialize. Maybe affordability remained just out of reach.

But they haven’t disappeared. The data suggests they’re still out there, still watching.

Four Years of Delayed Moves

Step back further and the latent demand picture grows clearer. Americans have delayed moves for nearly four years now, since mortgage rates first spiked in 2022. Surveys show the share of homeowners who want to move within two years has jumped from 10% to 25% since the pandemic. That represents millions of households putting plans on hold: growing families who need more space, empty nesters ready to downsize, workers who could benefit from relocating.

Life doesn’t wait forever. Divorces happen. Job transfers come through. Kids outgrow bedrooms. At some point, the need to move tends to overwhelm the desire to cling to a 3% mortgage.

What Unlocks the Waiting Buyers

What might release this pent-up demand? Mortgage rates are part of the story, but not all of it.

We’ve seen rates dip toward 6% three times since 2022: early 2023, September 2024, and September 2025. Each time, buyer activity picked up noticeably. The pattern appears consistent: at 6.5%, buyers have been staying on the sidelines; near 6%, we see demand pick up. Our forecast has rates averaging around 6.4% in 2026, with potential dips into the high 5s if the labor market weakens.

But the labor market itself may matter just as much. The hiring rate has fallen to 3.2%, a level that looks recessionary even though unemployment remains relatively low. Workers are “job hugging,” reluctant to change positions because new opportunities feel scarce. And when people won’t change jobs, they often won’t change homes either.

An uptick in the hiring rate could be a significant catalyst. If businesses start adding jobs more aggressively, worker confidence tends to follow. People become willing to take new positions, accept relocations, make the kind of life changes that generate housing transactions. The ideal scenario for housing in 2026 might actually be a combination: improving hiring even as unemployment edges up slightly due to more people entering the workforce. That mix could keep rates low while giving buyers the confidence to act.

Cheaper mortgage rates help mobility of course, but keep an eye on hiring.

What This Might Mean for 2026

The housing market isn’t frozen because buyers vanished. It appears frozen because many buyers are waiting. The demand seems to exist, documented in withdrawal patterns, mortgage applications, and survey data. It’s visible in the 150,000+ additional delayed seller-buyer combinations from this year compared to last.

Our baseline forecast calls for modest home sales growth of around 5% in 2026. But the data on hidden demand suggests something stronger is possible. If mortgage rates cooperate, if hiring improves, if the psychological logjam finally clears, sales growth could potentially reach 8-10%. That would represent the strongest transaction growth of the post-pandemic era so far.