According to ATTOM’s Q3 2022 U.S. Residential Property Mortgage Origination Report, 1.97 million mortgages secured by residential property were originated in Q3 2022 in the U.S. The report noted that figure was down 19 percent from Q2 2022 – the sixth quarterly decrease in a row – and down 47 percent Q3 2021 – the biggest annual drop in 21 years.

The report also noted that the continued decline in residential lending resulted from double-digit downturns in both refinance and purchase loan activity, which far outweighed another increase in home-equity credit lines.

ATTOM’s latest report stated that overall, lenders issued $636.5 billion worth of mortgages in Q3 2022 – down quarterly by 22 percent and 46 percent annually. The report also stated that as with the number of loans, the annual decrease in the dollar volume of mortgages stood out as the largest since at least 2001.

Also according to the report, the continued dip in overall lending came as just 661,000 residential loans were rolled over into new mortgages and borrowers took out only 943,000 loans to buy homes during Q3 2022.

ATTOM’s Q3 2022 mortgage origination report noted that refinancing activity was down 31 percent from Q2 2022 and 68 percent from Q3 2021, dropping for six consecutive quarters to a level that is just one-quarter of what it was in early 2021. The report also noted that the dollar volume of refinance loans in Q3 2022 was down 33 percent from the prior quarter and 67 percent annually, to $212 billion.

Moreover, the report found that the number of purchase loans, meanwhile, slumped by 16 percent quarterly and 33 percent annually, while the dollar volume decreased to $353.9 billion.

ATTOM’s latest analysis also revealed that the median amount borrowed nationwide to buy a home went down in Q3 2022 for the first time in three years.

The report found that among homes purchased with financing in Q3 2022, the median loan amount was $315,000 – down 4.5 percent from $330,000 the prior quarter, following 10 straight increases. However, according to the report, that figure was still up 4.2 percent from $302,197 in the same period in 2021.

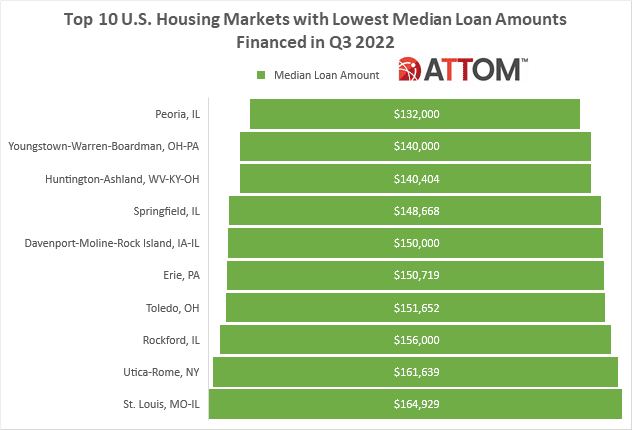

In this post, we take a deep data dive into the data behind the latest ATTOM mortgage origination report to uncover the top 10 U.S. housing markets with the lowest median loan amounts financed in Q3 2022. Those top metros include: Peoria, IL ($132,000); Youngstown-Warren-Boardman, OH-PA ($140,000); Huntington-Ashland, WV-KY-OH ($140,404); Springfield, IL ($148,668); Davenport-Moline-Rock Island, IA-IL ($150,000); Erie, PA ($150,719); Toledo, OH ($151,652); Rockford, IL ($156,000); Utica-Rome, NY ($161,639); and St. Louis, MO-IL ($164,929).

Want to learn more about the typical amount borrowed to finance home purchases and other mortgage origination trends in your area? Contact us to find out how!