Mortgage Origination

Mortgage Lending Slumps Again Across U.S. In Fourth Quarter Of 2022, To Lowest Point In Almost Nine Years

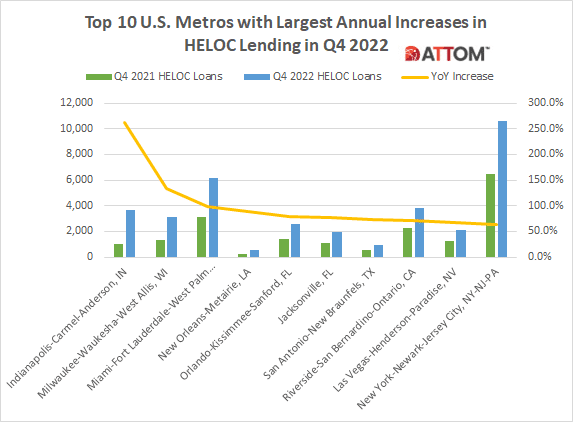

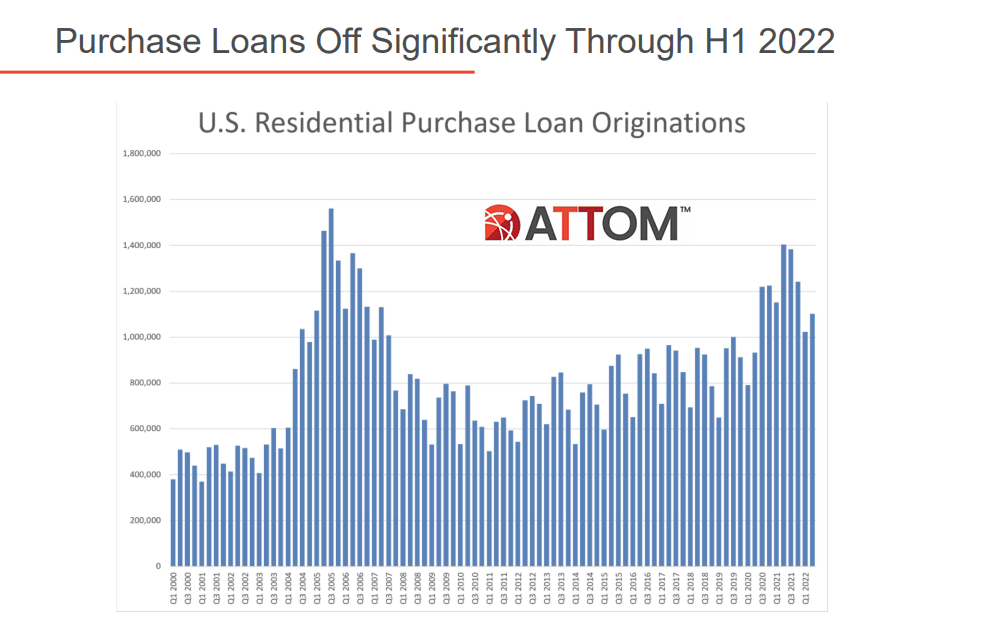

Total Loans Down Another 24 Percent Quarterly; Refinance Lending Drops Another 27 Percent Quarterly While Purchase Loans Decrease 26 Percent; Home-Equity Lending Dips for First Time in a Year IRVINE, Calif. – March 2, 2023 — ATTOM, a leading curator of land, property, and real estate data, today released its fourth-quarter 2022 U.S. Residential... Read More »

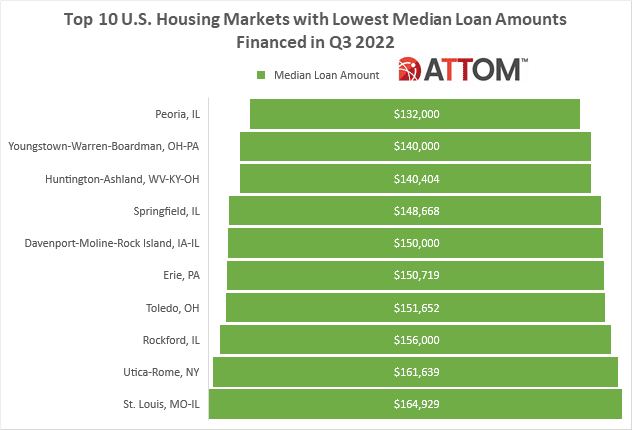

Top 10 U.S. Housing Markets with Lowest Median Loan Amounts

According to ATTOM’s Q3 2022 U.S. Residential Property Mortgage Origination Report, 1.97 million mortgages secured by residential property were originated in Q3 2022 in the U.S. The report noted that figure was down 19 percent from Q2 2022 – the sixth quarterly decrease in a row – and down 47 percent Q3 2021 – the biggest annual drop in 21 years.... Read More »

Steep Drop In Mortgage Lending Continues Across U.S. In Third Quarter, Hitting Three-Year Low

Total Loans Down Another 19 Percent Quarterly, Marking Sixth Straight Drop; Refinance Lending Declines Another 31 Percent Quarterly, While Purchase Loans Decrease 16 Percent; Drop-offs Far Outweigh Ongoing Rise in Home-Equity Lending IRVINE, Calif. – Nov. 17, 2022 — ATTOM, a leading curator of real estate data nationwide for land and property... Read More »

ATTOM Webinar Summary: Will Rising Mortgage Rates Sink All Ships?

This ATTOM webinar, presented by industry thought-leaders, Rick Sharga, EVP of Market Intelligence for ATTOM, Len Kiefer, Deputy Chief Economist for Freddie Mac, and Sean Mooney, VP of Product Management for ATTOM, addresses the impact rates have been having on the mortgage industry and the U.S. housing market. This webinar also provides a U.S.... Read More »

Top 10 U.S. Metros with Greatest Quarterly Increases in Purchase Mortgages

According to ATTOM’s Q2 2022 U.S. Residential Property Mortgage Origination Report, 2.39 million mortgages secured by residential property were originated in Q2 2022 in the U.S. That figure was down 13 percent from Q2 2022 – the fifth quarterly decrease in a row – and down 40 percent Q2 2021 – the biggest annual drop since 2014. The report noted... Read More »