The key takeaway from ATTOM’s just released Q1 2021 U.S. Residential Property Mortgage Origination Report, was that the continued increase in mortgage activity during Q1 2021 resulted from the latest jump in refinance mortgages. The report noted that jump in refinance mortgages, which more than doubled over the past year, outpaced declines in home-purchase lending and home-equity lines of credit.

ATTOM’s most recent residential property mortgage origination analysis reported that 3.77 million mortgages secured by residential property were originated in Q1 2021 in the U.S. According to the analysis, that figure was up 3 percent from Q4 2020 and 71 percent from Q1 2020 – to the highest level in more than 14 years.

The Q1 2021 report noted that increase also marked the first time that the total number of home mortgages rose from a fourth-quarter period to a first-quarter period since 2009. The Q1 2021 report also noted that lenders issued $1.16 trillion worth of mortgages in Q1 2021 – up 5 percent from Q4 2020 and 81 percent from Q1 2020, to the largest quarterly amount since at least 2000.

ATTOM’s latest residential property mortgage origination analysis stated that the 2.55 million home mortgages that lenders refinanced in Q1 2021 represented a 12 percent increase over Q4 2020 and a 113 percent spike over Q1 2020. The report noted the dollar amount of refinance loans rose to $777.5 billion, a 14 percent increase from Q4 2020 and a 114 percent jump from Q1 2020.

Also according to the Q1 2021 report, refinancing activity increased from Q4 2020 to Q1 2021 in 78.7 percent of the metro areas included in the analysis, among those with a population greater than 200,000 and at least 1,000 total loans in Q1 2021. The report noted that refinance activity rose by at least 10 percent in 54 percent of the metros analyzed, with the largest quarterly increases in Jackson, MS (up 92.9 percent); Springfield, MA (up 59.5 percent); Medford, OR (up 57.3 percent); Buffalo, NY (up 55 percent) and Macon, GA (up 53.3 percent).

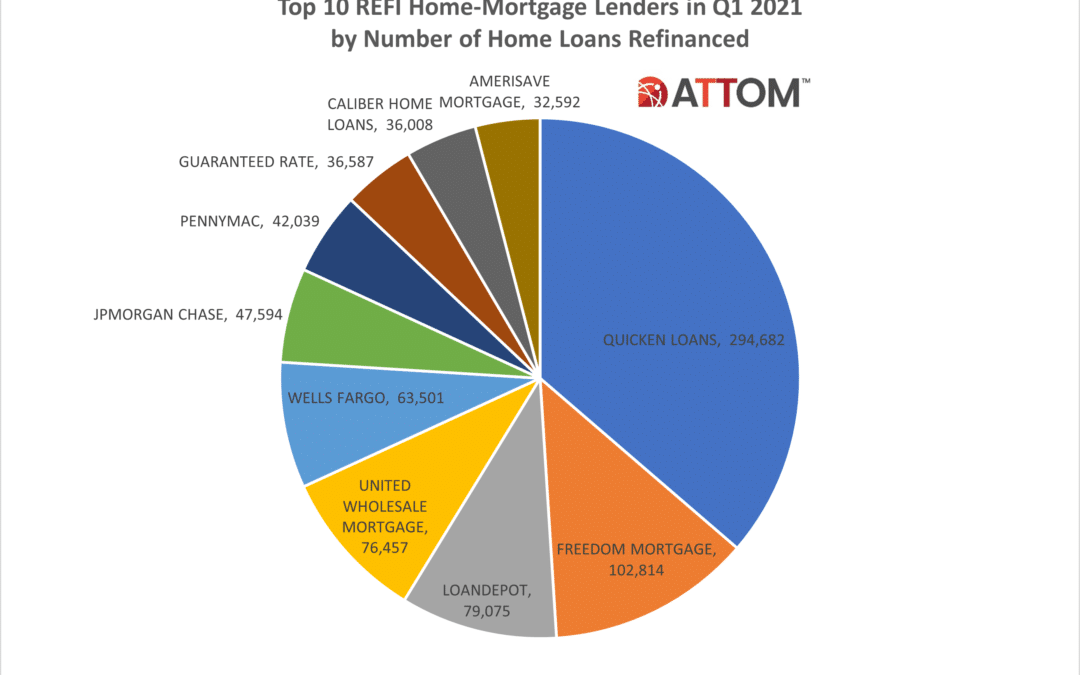

In this post, we take a deep dive into the data behind ATTOM’s Q1 2021 U.S. Residential Property Mortgage Origination Report to uncover the top 10 REFI mortgage lenders in Q1 2021 nationwide. Those lenders include: QUICKEN LOANS (294,682 REFI loans); FREEDOM MORTGAGE (102,814 REFI loans); LOANDEPOT (79,075 REFI loans); UNITED WHOLESALE MORTGAGE (76,457 REFI loans); WELLS FARGO (63,501 REFI loans); JPMORGAN CHASE (47,594 REFI loans); PENNYMAC (42,039 REFI loans); GUARANTEED RATE (36,587 REFI loans); CALIBER HOME LOANS (36,008 REFI loans); and AMERISAVE MORTGAGE (32,592 REFI loans).

ATTOM’s Q1 2020 mortgage origination analysis also reported refinance mortgages accounted for at least three-quarters of all loans in 9.5 percent of the metro areas included with sufficient data. Metros with a population of at least 1 million where refinance loans represented the largest portion of all mortgages in Q1 2021 were Atlanta, GA (85.3 of all mortgages); Detroit, MI (76.3 percent); Boston, MA (75.6 percent); Buffalo, NY (75.6 percent) and Washington, DC (75.6 percent).

Another important takeaway from the Q1 2021 report was the median down payment on single-family houses and condos purchased with financing in Q1 2021 was $18,700, down 19.6 percent from $23,250 in Q4 2020, but still up 41.1 percent from $13,250 in Q1 2020. The latest figure marked the first decrease since Q1 2020.

Want to learn more about home mortgage refinance or purchase activity in your market? Contact us to find out how!