ATTOM Data Solutions’ Q3 2020 U.S. Home Flipping Report presented a continuation of opposing trends in the third quarter of 2020, with flipping rates down but profits up, reflecting broader national housing market patterns as the worldwide Coronavirus continued spreading across the United States.

According to ATTOM’s latest home flipping analysis, while the home-flipping rate dropped again in Q3 2020, both profits and profit margins increased. The gross profit on the typical home flip nationwide rose in Q3 2020 to $73,766 – the highest amount since at least 2000. That amount was up from $69,000 in Q2 2020 and from $61,800 in Q3 2019.

The Q3 home flipping report stated that gain pushed profit margins up, with the typical gross flipping profit of $73,766 translating into a 44.4 percent ROI compared to the original acquisition price. The gross flipping ROI was up from 42.9 percent in Q2 2020 and 40.3 percent in Q3 2019. The report noted the improvement in the typical ROI marked the second consecutive year-over-year increase following nine straight quarters of declines.

ATTOM’s third quarter home flipping analysis reported that 57,155 single-family homes and condos were flipped in the U.S. in the third quarter, representing 5.1 percent of all home sales, or one in 20 transactions. That rate was down from 6.7 percent of all home sales in Q2 2020, or one in 15, and from 5.5 percent, or one in 18 sales, in Q3 2020.

Also according to the report, home flips as a portion of all home sales decreased from Q2 to Q3 2020 in 93.1 percent of the metro areas analyzed. Among metros a population of 200,000 or more and at least 50 home flips in Q3 2020, the largest quarterly decreases in the home flipping rate came in Killeen, TX (rate down 44.5 percent); Savannah, GA (down 43 percent); York, PA (down 42 percent); Greeley, CO (down 41.5 percent) and Springfield, MA (down 39.8 percent).

ATTOM’s Q3 2020 home flipping analysis also cited the areas with the biggest increases in home-flipping rates. Those areas were in Davenport, IA (rate up 18.5 percent); Hilton Head, SC (up 16.8 percent); Scranton, PA (up 12.2 percent); Amarillo, TX (up 10.9 percent) and Kalamazoo, MI (up 7.7 percent).

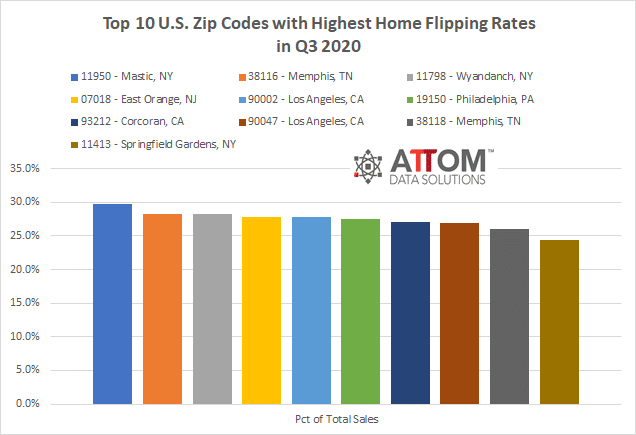

In this post, we take a deep data dive, drilling down to the zip code level, to discover the hot spots where the home flipping rate was the highest in Q3 2020. Among U.S. zip codes with 10 or more flips in the third quarter of 2020, the top 10 zips with the highest home flipping rates included: 11950 – Mastic, NY (29.8 percent of total sales); 38116 – Memphis, TN (28.2 percent of total sales); 11798 – Wyandanch, NY (28.2 percent of total sales); 07018 – East Orange, NJ (27.8 percent of total sales); 90002 – Los Angeles, CA (27.8 percent of total sales); 19150 – Philadelphia, PA (27.6 percent of total sales); 93212 – Corcoran, CA (27.0 percent of total sales); 90047 – Los Angeles, CA (26.9 percent of total sales); 38118 – Memphis, TN (26.0 percent of total sales); and 11413 – Springfield Gardens, NY (24.4 percent of total sales).

In terms of home flipping returns, according to the third quarter report, home flipping profit margins increased from Q3 2019 to Q3 2020 in 65.4 percent of the markets analyzed. Markets reported with the biggest gains included Brownsville, TX (return on investment up 182.9 percent); Austin, TX (up 176.4 percent); Waco, TX (up 157.4 percent); Springfield, MO (up 145.3 percent) and Savannah, GA (up 143.6 percent).

ATTOM’s most recent home flipping report noted that the highest Q3 2020 home flipping profits, measured in dollars, were again concentrated in the West and Northeast. The analysis reported that among those metros with enough data to analyze, 22 of the top 25 were in those regions, led by San Jose, CA (gross profit of $290,000); Ventura, CA ($180,000); Bridgeport, CT ($177,500); Los Angeles, CA ($161,500) and San Francisco, CA ($158,500).

In this post, we drill down again to the zip code level to discover the top 10 U.S. zip codes with 10 or more flips in Q3 2020, that posted the highest home flipping profits in dollars. Those zips included: 06880 – Westport, CT ($1,129,500 raw profit); 85255 – Scottsdale, AZ ($409,313 raw profit); 20011 – Washington, DC ($382,000 raw profit); 97035 – Lake Oswego, OR ($374,750 raw profit); 90042 – Los Angeles, CA ($370,000 raw profit); 60126 – Elmhurst, IL ($311,250 raw profit); 11413 – Springfield Gardens, NY ($305,000 raw profit); 20002 – Washington, DC ($299,750 raw profit); 97211 – Portland, OR ($297,000 raw profit); and 07039 – Livingston, NJ ($295,000 raw profit).

Want to learn more about home flipping trends in your area? Contact us to find out how!