Real Estate News – Recent Articles

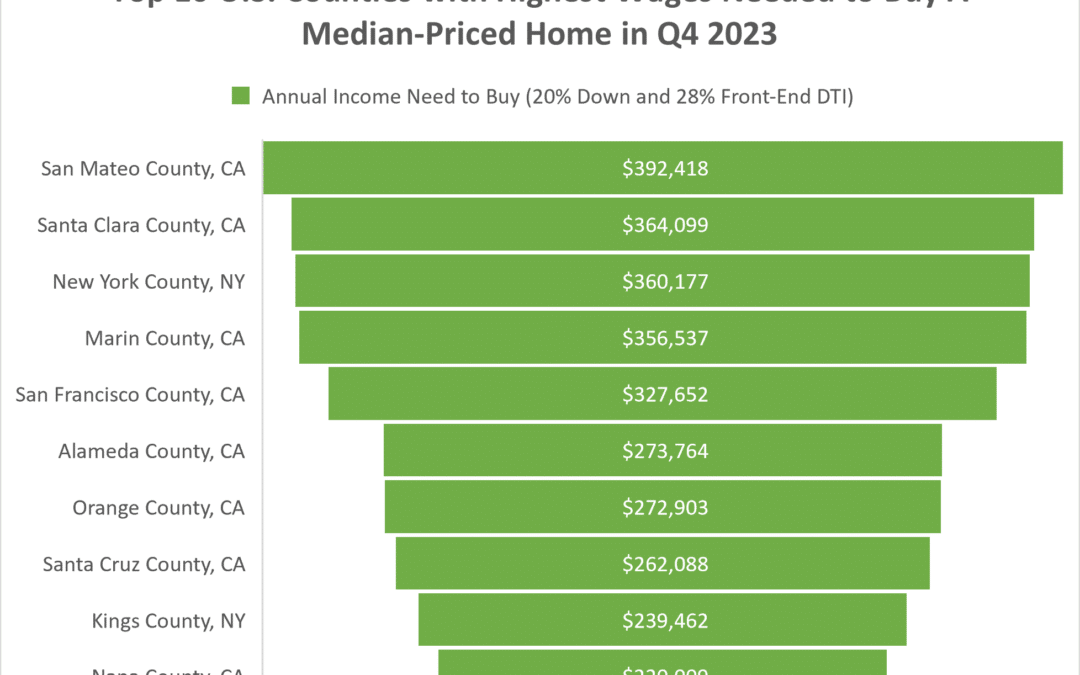

Home Affordability Remains Difficult Across U.S. During Fourth Quarter Even As Prices Dip Downward

Major Home-Ownership Expenses Again Require One-Third of Average Wage Nationwide, a 16-Year High; Historical Affordability Also Stays at Worst Point Since 2007; But Both Measures End Nearly Three-Year Slide Amid Mixed Trends in Home Prices and Mortgage Rates IRVINE, Calif. – Dec. 21, 2023 —ATTOM, a leading curator of land, property, and real... Read More »

Home Flipping Activity Keeps Falling While Investor Profits Keep Rising Across U.S. In Third Quarter Of 2023

Flipping Rate Declines for Second Straight Quarter While Profit Margins Increase Again; Investment Returns Continue Rebounding from Two-Year Decline; Raw Flipping Profits Also Up, to High Point Since Middle of 2022 IRVINE, Calif. – Dec. 14, 2023 — ATTOM, a leading curator of land, property, and real estate data, today released its third-quarter... Read More »

Seasonal Influence Eases U.S. Foreclosure Activity, Marking Slight Decline

Completed Foreclosures Decrease 23 Percent from Last Month; Foreclosure Starts Increase Annually in TX, CA and FL IRVINE, Calif. — Dec. 12, 2023 — ATTOM, a leading curator of land, property, and real estate data, today released its November 2023 U.S. Foreclosure Market Report, which shows there were a total of 32,120 U.S. properties with... Read More »

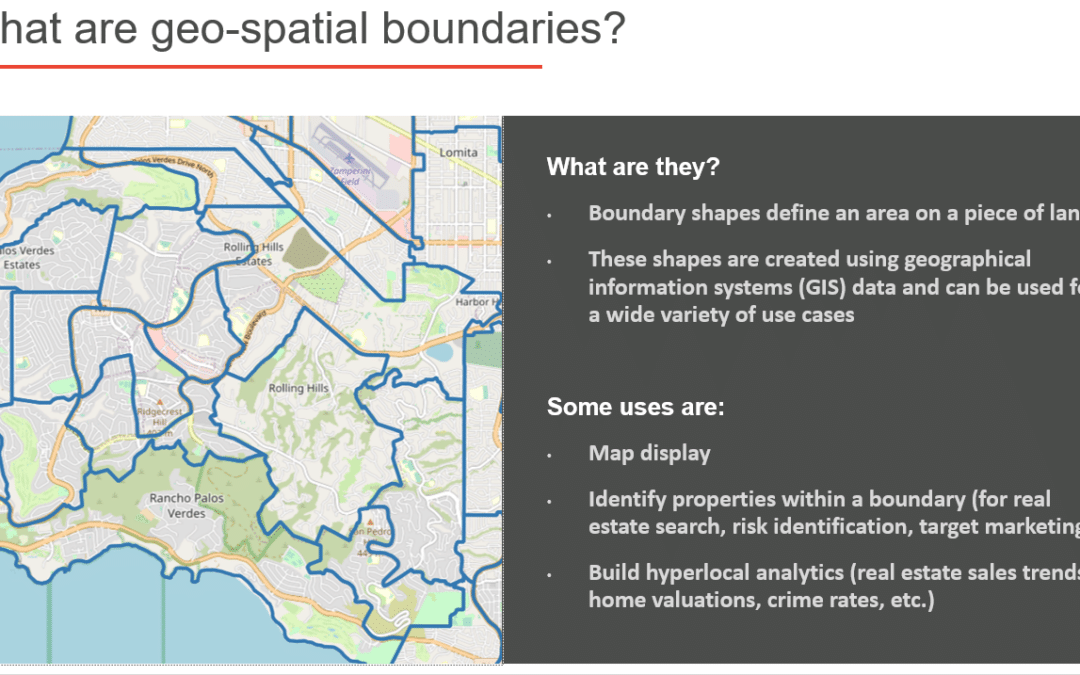

ATTOM Webinar Summary: Understanding Boundary Data Products for Your Business

This ATTOM webinar, presented by Sean Mooney, VP of Product Management for ATTOM, discusses ATTOM’s premier geospatial boundary products, including Parcel, Neighborhoods, School Attendance Areas, and more. During this webinar, Sean takes a deep dive into the various ways ATTOM’s boundary products and associated contextual data sets – such as... Read More »

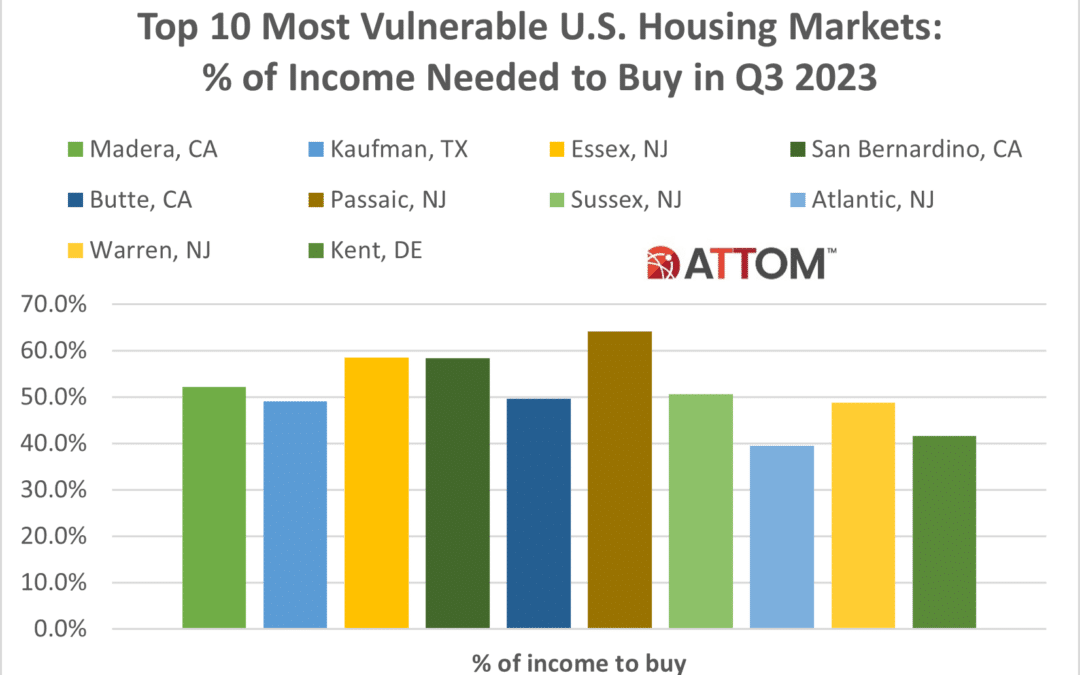

A Deep Dive Into the Top 10 Most Vulnerable U.S. Housing Markets

According to ATTOM’s just released Q3 2023 Special Housing Risk Report, California, New Jersey and Illinois have the highest concentrations of housing markets most vulnerable to declines, based on home affordability, foreclosures, underwater mortgages and other measures in the third quarter. The report found that the biggest clusters are in the... Read More »