With interest rates near all-time lows, ATTOM Data Solutions uncovered this week that refinance mortgages originated in Q4 2019 represented an estimated $391.3 billion in total dollar volume. That’s according to ATTOM’s newly released Q4 2019 U.S. Residential Property Mortgage Origination Report. The report noted that refinance dollar volume is up 19 percent from Q3 2019, and up 138 percent from Q4 2018, to the highest level since Q1 2013.

ATTOM’s latest mortgage origination analysis reported that 1.27 million refinance mortgages secured by residential property (1 to 4 units) were originated in Q4 2019, up 20 percent from Q3 2019 and up 104 percent from Q4 2018, to the highest point since Q3 2013. While total residential loan originations rose 40 percent, year-over-year, in Q4 2019 to 2.27 million, the highest point since Q3 2016.

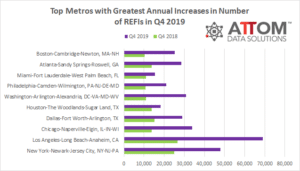

On the metro area level according to the report, residential refinance mortgage originations increased, year over year, in 207 of the 209 metros with a population greater than 200,000, including the greater metro areas of New York, NY (up 91.5 percent); Los Angeles, CA (up 158.8 percent); Chicago, IL (up 144.5 percent); Dallas, TX (up 90.0 percent) and Houston, TX (up 32.9 percent). The only metro areas that ran counter to the national year-over-year trend were Beaumont, TX (down 6.8 percent) and McAllen, TX (down 9.1 percent).

Rounding out the full list of the top 10 largest metros seeing the greatest annual increases in the number of refis in Q4 2019, the remaining areas included: Washington-Arlington-Alexandria, DC-VA-MD-WV (up 180 percent); Philadelphia-Camden-Wilmington, PA-NJ-DE-MD (up 94 percent); Miami-Fort Lauderdale-West Palm Beach, FL (up 42 percent); Atlanta-Sandy Springs-Roswell, GA (up 108 percent); and Boston-Cambridge-Newton, MA-NH (up 143 percent).

ATTOM’s Q4 2019 mortgage origination report also revealed that lenders originated 685,898 residential purchase mortgages in Q4 2019, down 13.3 percent from Q3 2019, but up 3.1 percent from Q4 2018. On the metro level, residential purchase mortgage originations increased from Q4 2018 in 141 of the 209 metros with a population greater than 200,000, including the greater metros of Los Angeles, CA (up 13.8 percent); Chicago, IL (up 1.6 percent); Washington, DC (up 3.7 percent); Philadelphia, PA (up 2.1 percent) and Miami, FL (up 2.9 percent).

As well, the report noted that a total of 307,180 home equity lines of credit (HELOCs) were originated on residential properties in Q4 2019, down 8.9 percent from Q3 2019 and down 5.5 percent from Q4 2018. Also, mortgages backed by the Federal Housing Administration (FHA) accounted for 294,206, or 13 percent, of all residential property loans originated in Q4 2019. That number was down from 289,593, or 13.2 percent, of all loans in Q3 2019, but up from 199,004, or 12.3 percent of all loans in Q4 2018.

Want to learn more about how refinance mortgages, mortgage purchases, HELOCs, FHA or VA loans are trending in your area? Contact us to find out how!