According to ATTOM’s newly released November 2021 U.S. Foreclosure Market Report, foreclosure filings were down 5 percent from October 2021 but up 94 percent from November 2020 – the 7th consecutive month of annual increases.

ATTOM’s latest foreclosure market analysis shows there were a total of 19,479 U.S. properties with foreclosure filings. The report also shows that nationwide one in every 7,055 housing units had a foreclosure filing in November 2021.

Which states saw the highest foreclosure rates in November 2021? They included Illinois (one in every 3,187 housing units with a foreclosure filing); Florida (one in every 3,319 housing units); Ohio (one in every 3,669 housing units); Delaware (one in every 3,800 housing units); and New Jersey (one in every 4,096 housing units).

The report also revealed that among the 220 metro areas with a population of at least 200,000, those with the highest foreclosure rates in November 2021 were Cleveland, OH (one in every 1,746 housing units with a foreclosure filing); Lakeland, FL (one in every 2,345 housing units); Ocala, FL (one in every 2,485 housing units); Savannah, GA (one in every 2,618 housing units); and Miami, FL (one in every 2,626 housing units).

ATTOM’s latest foreclosure market report noted that among metro areas with a population greater than 1 million, with the worst foreclosure rates in November 2021 included Cleveland, OH and Miami, FL were: Chicago, IL (one in every 2,644 housing units); Jacksonville, FL (one in every 2,733 housing units); and Orlando, FL (one in every 3,536 housing units).

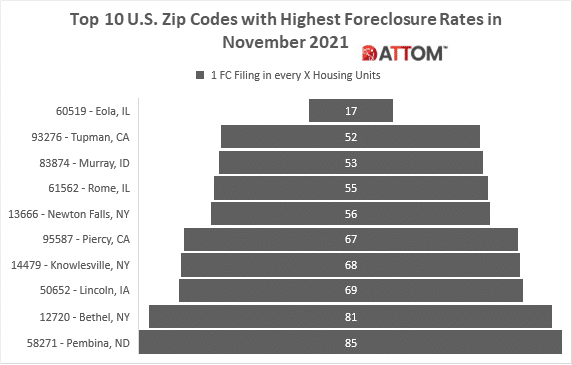

In this post, we dive deep into the data behind the ATTOM November 2021 U.S. Foreclosure Market Report to uncover the top 10 U.S. zip codes with the highest foreclosure rates in November 2021. Those zips include: 60519 in Eola, IL (one in every 17 housing units); 93276 in Tupman, CA (one in every 52 housing units); 83874 in Murray, ID (one in every 53 housing units); 61562 in Rome, IL (one in every 55 housing units); 13666 in Newton Falls, NY (one in every 56 housing units); 95587 in Piercy, CA (one in every 67 housing units); 14479 in Knowlesville, NY (one in every 68 housing units); 50652 in Lincoln, IA (one in every 69 housing units); 12720 in Bethel, NY (one in every 81 housing units); and 58271 in Pembina, ND (one in every 85 housing units).

The November 2021 foreclosure report also shows that foreclosure starts were down 3 percent from October 2021 but up 99 percent from November 2020, as lenders started the foreclosure process on 10,471 U.S. properties during the month of November 2021. The report also revealed that among states with at least 100 foreclosure starts in November 2021, those with the greatest monthly decreases in foreclosure starts included North Carolina (down 46 percent); New Jersey (down 31 percent); Washington (down 28 percent); Tennessee (down 28 percent); and Nevada (down 22 percent).

The report also found that completed foreclosures (REOs) in November 2021 were down 24 percent October 2021 – the first monthly decrease since May 2021 – but up 14 percent from November 2021, as lenders repossessed 2,292 U.S. properties. The report noted that states with the greatest number of REOs in November 2021 included Illinois (248 REOs); California (178 REOs); Florida (167 REOs); Pennsylvania (132 REOs); and Michigan (130 REOs).

Want to learn more about foreclosure trends in your area? Contact us to find out how!