According to ATTOM’s just released Year-End 2021 U.S. Home Flipping Report, the number of single-family homes and condos flipped in the U.S. in 2021 was up 26 percent from 2020, to the highest point since 2006. Although, home flips in 2021 represented just 5.5 percent of all home sales in the nation during the year, down from 5.8 percent in 2020 and 6.1 percent in 2019.

ATTOM’s latest home flipping analysis found that home flips as a portion of all home sales decreased from 2020 to 2021 in 53 percent of the metro areas analyzed, with nine of the 10 biggest decreases in the Northeast and West. Those were led by Honolulu, HI (rate down 83 percent); Atlantic City, NJ (down 73 percent); Manchester, NH (down 57.7 percent); Rochester, NY (down 48 percent) and Cedar Rapids, IA (down 47.8 percent). Metros qualified for the analysis if they had a population of at least 200,000 and at least 100 home flips in 2021.

The year-end report stated that home flipping rates increased from 2020 to 2021 in 47 percent of metro areas with sufficient data, with the largest annual increases in Provo, UT (rate up 114.3 percent); Salt Lake City, UT (up 113.4 percent); Austin, TX (up 111.2 percent); College Station, TX (up 97.4 percent) and Ogden, UT (up 95 percent)

Also according to the report, among those counties with at least 50 home flips in 2021, there were only 25 counties where home flips accounted for at least 10 percent of all home sales last year. The top five among that group included McCurtain County, OK (northeast of Dallas, TX) (15 percent); Logan County, KY (north of Nashville, TN) (13 percent); Gilmer County, GA (north of Marietta) (12.4 percent); Fentress County, TN (northwest of Knoxville) (12.1 percent) and Greene County, GA (south of Athens) (11.7 percent).

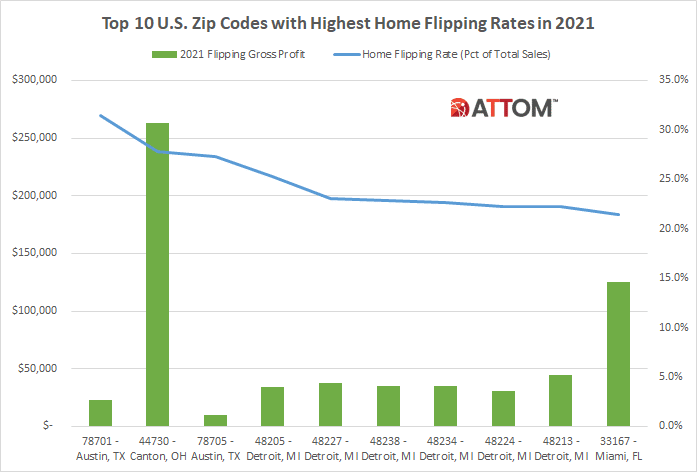

ATTOM’s year-end home flipping report noted that among U.S. zip codes with a population of 5,000 or more and at least 10 home flips in 2021, there were 13 zip codes where flips accounted for at least 20 percent of all home sales. Those zips were led by 78701 in Travis County (Austin), TX (31.4 percent); 44730 in Stark County (Canton), OH (27.8 percent); 78705 in Travis County (Austin), TX (27.3 percent); 48205 in Wayne County (Detroit), MI (25.3 percent) and 48227 in Wayne County (Detroit), MI (23.1 percent).

In this post, we take a deeper dive into the data at the zip code level to uncover not only the complete list of those top 10 zips where flips accounted for the largest percentage of all home sales, but we also unveil the gross flipping profits realized in those zip codes. Rounding out the complete list of the top 10 zips with the largest shares of home flips in 2021 are: 48238 in Detroit, MI (22.8 percent); 48234 in Detroit, MI (22.6 percent); 48224 in Detroit, MI (22.2 percent); 48213 in Detroit, MI (22.2 percent); and 33167 in Miami, FL (21.5 percent).

Among those top zips flipped in 2021, the gross flipping profits realized were: 78701 in Austin, TX ($22,735); 44730 in Canton, OH ($263,150); 78705 in Austin, TX ($9,610); 48205 in Detroit, MI ($34,000); 48227 in Detroit, MI ($37,400); 48238 in Detroit, MI ($35,000); 48234 in Detroit, MI ($35,000); 48224 in Detroit, MI ($30,560); 48213 in Detroit, MI ($44,916); and 33167 in Miami, FL ($125,000).

Top 10 U.S. Zip Codes with Highest Home Flipping Rates in 2021

ATTOM’s latest home flipping analysis also reported that even as quick-turnaround sales by investors shot up, gross profit margins on home flips in 2021 sank to their lowest level in more than a decade after dropping at the fastest pace in more than 15 years. The report stated that homes flipped in 2021 typically generated a gross profit of $65,000 nationwide, down 3 percent from $67,000 in 2020, translating into just a 31 percent ROI compared to the original acquisition price – the lowest margin since 2008.

Want to learn more about home flipping rates and profits in your area? Contact us to find out how!