ATTOM Data Solutions’ newly released February 2020 U.S. Foreclosure Market Report reveals that nationwide foreclosure activity hit an all-time low with a total of 48,004 U.S. properties with foreclosure filings recorded — the lowest number since tracking began in April 2005.

The report also noted that completed foreclosures (REOs) in February 2020 continued an annual decline with 10,469 U.S. properties repossessed by lenders. That number is up 1 percent from January 2020 but down 8 percent from February 2019.

ATTOM’s most recent foreclosure activity analysis also reported that nationwide one in every 2,841 housing units had a foreclosure filing in February 2020. The states with the highest foreclosure rates included: New Jersey (one in every 1,457 housing units with a foreclosure filing); Illinois (one in every 1,507 housing units); Delaware (one in every 1,628 housing units); South Carolina (one in every 1,688 housing units); and Maryland (one in every 1,713 housing units).

On the metro level, ATTOM’s analysis noted that among the 220 metropolitan statistical areas with a population of at least 200,000, those with the highest foreclosure rates in February 2020 were Bakersfield, CA (one in every 948 housing units with a foreclosure filing); Atlantic City, NJ (one in every 1,032 housing units); Columbia, SC (one in every 1,042 housing units); Rockford, IL (one in every 1,049 housing units); and Fayetteville, NC (one in every 1,089 housing units).

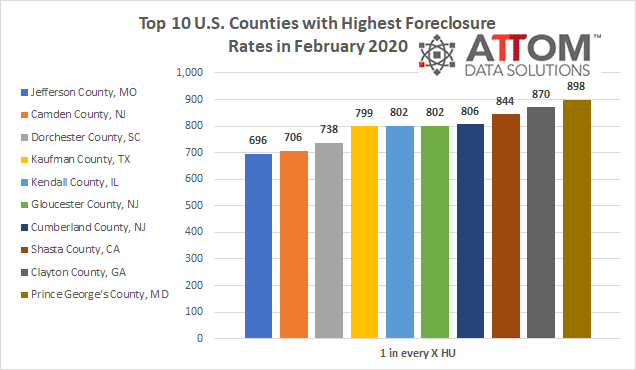

Drilling down to the county level, here we unveil the top 10 U.S. counties with a population of 100,000 or more with the highest foreclosure rates in February 2020: Jefferson County, MO (one in every 696 housing units with a foreclosure filing; Camden County, NJ (one in every 706 housing units); Dorchester County, SC (one in every 738 housing units); Kaufman County, TX (one in every 799 housing units); Kendall County, IL (one in every 802 housing units); Gloucester County, NJ (one in every 802 housing units); Cumberland County, NJ (one in every 806 housing units); Shasta County, CA (one in every 844 housing units); Clayton County, GA (one in every 870 housing units); and Prince George’s County, MD (one in every 898 housing units).

Also according to ATTOM’s February 2020 foreclosure market report, lenders started the foreclosure process on 27,058 U.S. properties. That number is up 3 percent from January 2020 but down 9 percent from February 2019 — the thirteenth consecutive month showing an annual decline.

The analysis reported the states that saw double digit increases in foreclosure starts from January 2020 included: Nevada (up 63 percent); Oregon (up 49 percent); Washington (up 47 percent); Texas (up 28 percent); and Michigan (up 20 percent).

Posting month-over-month decreases in foreclosure starts, counter to the national trend, states including Washington D.C., numbered 31 in February 2020 and included: Minnesota (down 38 percent); Tennessee (down 26 percent); Virginia (down 19 percent); New York (down 15 percent); and Ohio (down 13 percent).

Want to take a deeper dive into the data to learn how foreclosures are trending in your area? Contact us to find out how!