In October 2019, foreclosure filings climbed upward, increasing 13 percent from the previous month, according to ATTOM Data Solutions’ newly released October 2019 U.S. Foreclosure Activity Report.

The report featured the rise of foreclosure completions (or REOs) in October, which reached the highest point in 2019. Lenders repossessed 13,484 U.S. properties through REOs in October, up 14 percent from the previous month.

ATTOM’s October foreclosure report also noted that foreclosure starts increased monthly in 36 states. Lenders started the foreclosure process on 28,667 U.S. properties in October, up 17 percent from last month but down 1 percent from a year ago — the first double-digit month-over-month increase since February 2018.

On the state level, states that saw double digit increases from last month included: Arizona (up 52 percent); Ohio (up 52 percent); Florida (up 48 percent); New Jersey (up 47 percent); and California (up 36 percent).

On the other hand, 13 states including Washington, DC posted month-over-month decreases in foreclosure starts in October, including Maryland (down 42 percent); Idaho (down 36 percent); Delaware (down 32 percent); Nebraska (down 26 percent); and Utah (down 25 percent).

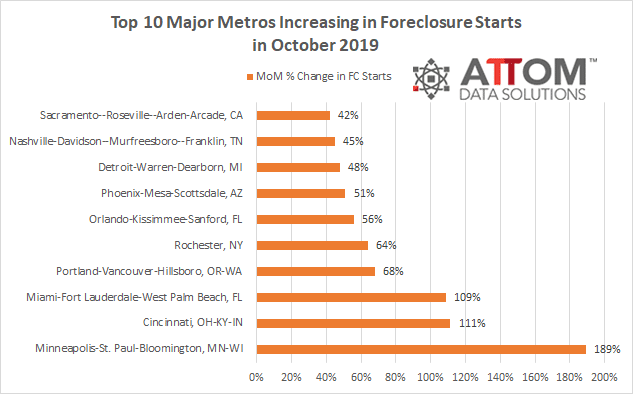

Drilling down to the metro level, in looking at the major metros with a population greater than 1 million, the top 10 metros that saw month-over-month increases in foreclosure starts were: Minneapolis-St. Paul-Bloomington, MN-WI (up 189 percent); Cincinnati, OH-KY-IN (up 111 percent); Miami-Fort Lauderdale-West Palm Beach, FL (up 109 percent); Portland-Vancouver-Hillsboro, OR-WA (up 68 percent); Rochester, NY (up 64 percent); Orlando-Kissimmee-Sanford, FL (up 56 percent); Phoenix-Mesa-Scottsdale, AZ (up 51 percent); Detroit-Warren-Dearborn, MI (up 48 percent); Nashville-Davidson–Murfreesboro–Franklin, TN (up 45 percent); and Sacramento–Roseville–Arden-Arcade, CA (up 42 percent).

And, the top 10 major metros with a population greater than 1 million that saw month-over-month decreases in foreclosure starts were: New Orleans-Metairie, LA (down 36 percent); Pittsburgh, PA (down 36 percent); Washington-Arlington-Alexandria, DC-VA-MD-WV (down 34 percent); Salt Lake City, UT (down 33 percent); Philadelphia-Camden-Wilmington, PA-NJ-DE-MD (down 29 percent); Seattle-Tacoma-Bellevue, WA (down 23 percent); Milwaukee-Waukesha-West Allis, WI (down 11 percent); Kansas City, MO-KS (down 8 percent); Baltimore-Columbia-Towson, MD (down 7 percent); and Birmingham-Hoover, AL (down 7 percent).

ATTOM’s October foreclosure analysis also reported that nationwide one in every 2,453 housing units had a foreclosure filing during the month.

States with the highest foreclosure rates were New Jersey (one in every 1,316 housing units with a foreclosure filing); Illinois (one in every 1,336 housing units); Maryland (one in every 1,484 housing units); South Carolina (one in every 1,534 housing units); and Florida (one in every 1,571 housing units).

Want to see how your area ranks in foreclosure completions, foreclosure starts or foreclosure rate? Contact us to find out how!