ATTOM Data Solutions’ new Q3 2019 U.S. Home Equity and Underwater Report issued this week revealed that homeowners were found far more likely to be equity rich than seriously underwater.

According to the report, in the third quarter of 2019, 14.4 million residential properties in the U.S. were considered equity rich, meaning the combined estimated amount of loans secured by those properties was 50 percent or less of their estimated market value. The count of equity rich properties in Q3 represented 26.7 percent, or about one in four, of 54 million mortgaged homes.

ATTOM’s Chief Product Officer Todd Teta stated in the report, “There are notable equity gaps between regions and market segments. But as home values keep climbing, homeowners are seeing their equity building more and more, while those with properties still worth a lot less than their mortgages represent just a small segment of the market.”

The report primarily focused on the equity rich areas; however, the report also noted that just 3.5 million, or one in 15, mortgaged homes in Q3 2019 were considered seriously underwater, with a combined estimated balance of loans secured by the property at least 25 percent more than the property’s estimated market value. That figure represented 6.5 percent of all properties with a mortgage.

Which parts of the country are seeing homeowners struggling to stay afloat?

As cited in ATTOM’s report, the top 10 states with the highest shares of mortgages that were seriously underwater in Q3 were all in the South and Midwest, led by Louisiana (16.5 percent seriously underwater); Mississippi (15.8 percent); West Virginia (14.2 percent); Iowa (14.0 percent); and Arkansas (13.1 percent).

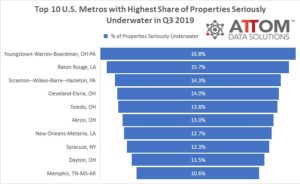

The report noted that among the 107 metro areas included in the analysis, with a population greater than 500,000, those with the highest share of mortgages that were seriously underwater included Youngstown, OH (16.8 percent); Baton Rouge, LA (15.7 percent); Scranton, PA (14.3 percent); Cleveland, OH (14.0 percent); and Toledo, OH (13.8 percent).

Rounding out the top 10 metros with the highest share of properties seriously underwater were: Akron, OH (13.0 percent); New Orleans-Metairie, LA (12.7 percent); Syracuse, NY (12.3 percent); Dayton, OH (11.5 percent); and Memphis, TN-MS-AR (10.6 percent).

Drilling down to the zip code level, more than 25 percent of all properties were seriously underwater in 160 zip codes analyzed in the Q3 report.

There were 160 U.S. zip codes among the 8,213 zip codes with at least 2,000 properties with mortgages, where more than a quarter of all properties with a mortgage were seriously underwater. The largest number of those zip codes were in the Cleveland, St. Louis, Philadelphia, Chicago and Milwaukee metropolitan statistical areas.

The report included the top five zip codes with the highest share of seriously underwater properties: 71446 in Leesville, LA (65.1 percent seriously underwater); 44110 in Cleveland, OH (61.9 percent); 08611 in Trenton, NJ (61.8 percent); 53206 in Milwaukee, WI (60.3 percent); and 63115 in St. Louis, MO (59 percent).

Here are the remaining zip codes in the top 10 with the highest share of seriously underwater properties: 44105 in Cleveland, OH (57.3 percent); 38106 in Memphis, TN (54.2 percent); 63137 in Saint Louis, MS (52.4 percent); 08104 in Camden, NJ (50.3 percent); and 44112 in Cleveland, OH (49.7 percent).

Want to see how your area ranks in home equity or underwater share? Contact us to find out how!