Whether you are new to real estate or a seasoned professional, you likely know there’s an opportunity to make money working with distressed properties. In fact, many skilled investors, agents, appraisers, and lenders are doing so.

To take advantage of the distressed property market, the place to start is with a complete list of distressed properties in the form of a lis pendens search for real estate professionals. But even before you do that, it’s a good idea to know what the term lis pendens actually means.

What Is a Lis Pendens?

The term is Latin in origin. Lis pendens is loosely defined as a translation of “suit pending” or pending legal action. When it comes to real property, a lis pendens is often filed by a mortgage lender when a borrower is no longer making payments, thus, initiating the foreclosure process. For that reason, lis pendens are also referred to as pre-foreclosures.

Here are some common questions asked about lis pendens.

Is a Lis pendens analogous to a 30, 60, or 90-day lateness on a credit report?

No. While they all deal with late payments, a lis pendens doesn’t inherently tell you how delinquent a borrower is, it just means the borrower is late on their payments. A 30/60/90 is a credit matter, whereas a lis pendens is a legal matter.

How long does a lender wait before filing a lis pendens?

It’s up to the individual lender to file a lis pendens, but prior to filing, the lender sends the borrower a Notice of Default. There’s no set number of months a borrower needs to be late before a lis pendens is filed.

Why is information about lis pendens so important?

Since a lis pendens is a matter of public record, it’s the first notice to the world that a property may be facing foreclosure. Having this information is invaluable to a potential buyer since it may discourage them from purchasing the property or they can use the information to negotiate a price below market value. Being privy to the legal status of a particular property provides a tremendous amount of leverage.

Where is the lis pendens notice filed?

Lis pendens real estate notices are generally filed in the county records office. That type of data isn’t typically available online, so a real estate professional would need to visit the recording office to access the information. ATTOM, however, does the legwork for you by aggregating the lis pendens data and making it available along with other property information on our property reports.

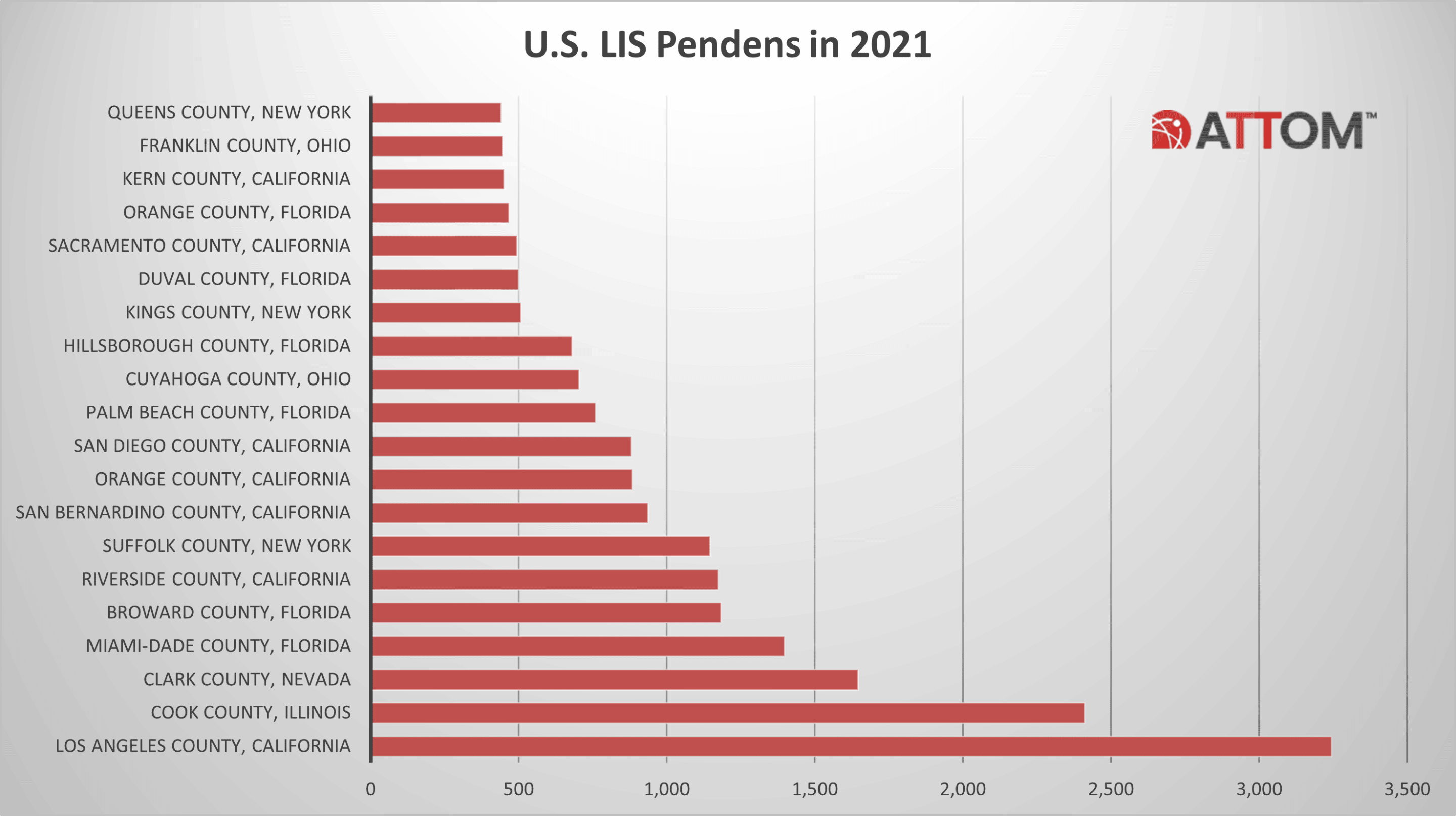

The following graphic illustrates the Top-20 Counties by volume of lis pendens filings for 2021.

How far back can I search for a lis pendens?

You can search as far back as you’d like. In this real estate climate, a property can take months, if not years, to foreclose.

How do I take advantage of a lis pendens?

That depends on what you’re trying to do. A real estate investor will want to contact an owner to buy the property. A real estate agent will also try to contact the owner to list the property or introduce them to a buyer. Lastly, the owner should negotiate a short sale with the bank if the amount of the mortgage is more than the property’s value,

What’s a short sale?

In summary, a short sale occurs when a property sells for less than the sum of the mortgage balances. You’ll often need lender approval to complete a short sale.

How Does ATTOM Help?

ATTOM has complete and up-to-date nationwide pre-foreclosure and foreclosure records and details— the largest footprint available from any property data provider. Data include notice of default (NODs) and lis pendens (LIS), notice of trustee’s sale (NTS) and notice of foreclosure sale (NFS), and bank real estate owned completed foreclosures (REOs).

A real estate appraiser may have a lender client who doesn’t realize a property is facing foreclosure. When the appraiser looks up the property, they can share the lis pendens information with the lender, saving them a great deal of time and money.

The distressed real estate market has been around for many years and is a significant component of the real estate economy despite every prediction to the contrary. Whether you’re actively pursuing these types of properties or not, ATTOM has the data you need.