ATTOM Data Solutions took an early look at home seller gains from January 2019 in the 20 markets anticipated to be covered by Case-Shiller next week.

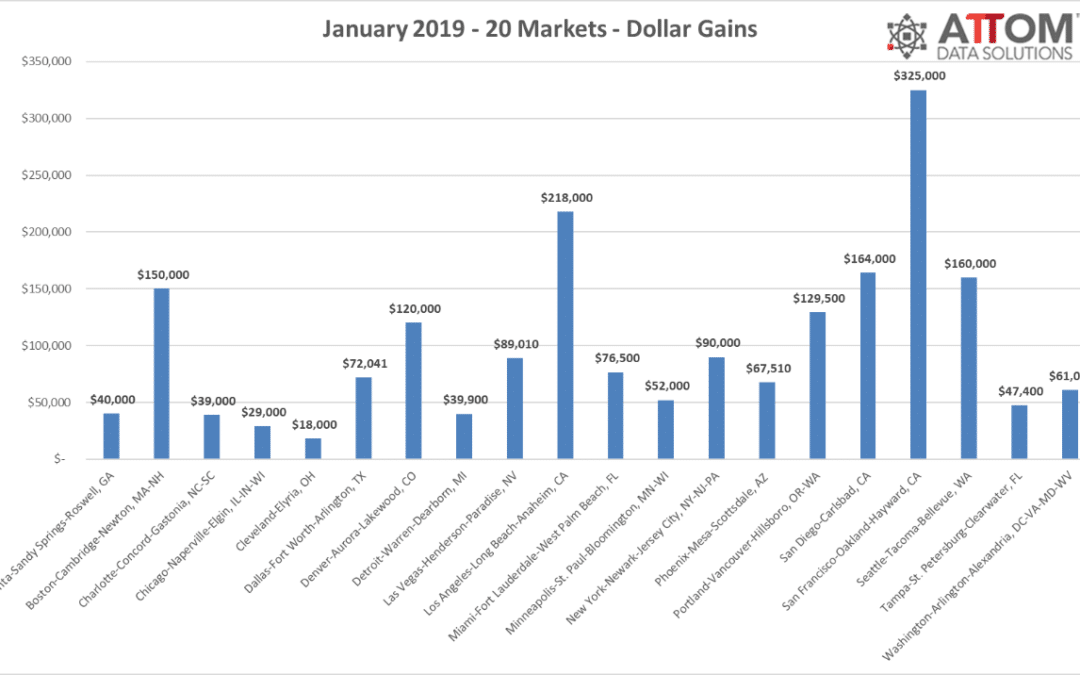

Among those 20 markets, San Francisco saw the greatest seller gains in January 2019, selling for an average of $325,000 more than their original purchase price. That price gain represented an average 73 percent return on the original purchase price, up 7 percent from December 2018 and up slightly by 1 percent from January 2018.

Following San Francisco with having the highest dollar amount in seller gains was Los Angeles. There, home sellers saw a dollar gain of $218,000, which represented an average 56.6 percent return, up 3 percent from this past December as well as annually.

Another top 20 market where the dollar gain in January 2019 represented an average 56.6 percent return on the original purchase price was Boston, where home sellers realized a dollar gain of $150,000. Boston had one of the highest annual increases in seller gains, up 8 percent from January 2018.

Rounding out the top three markets with the greatest seller gains in January 2019, was another California market – home sellers in San Diego sold for an average of $164,000 more than their original purchase price. That price gain represented an average 43.6 percent return on the original purchase price.

Among the markets that saw the least amount of dollar gains for home sellers in January 2019 were Cleveland and Chicago. Seller gains in both markets represented just over 16 percent return on the original purchase price. Home sellers in Cleveland sold for an average of $18,000 more than their original purchase price, while sellers in Chicago sold for an average of $29,000 more than their original purchase price.

The only three markets within the top 20 to see an annual decrease of seller gains included Seattle (down 1 percent), San Diego (down 5 percent) and Denver (down 9 percent).

Curious as to know which other markets saw the highest annual gains? To find out, contact us.