ATTOM’s newly released Q4 2021 U.S. Home Equity and Underwater Report reveals that 41.9 percent of mortgaged residential properties in the U.S. – nearly one of every two – were considered equity-rich in Q4 2021. That figure is up from 39.5 percent in Q3 2021 and from 30.2 percent in Q4 2020.

According to ATTOM’s latest home equity and underwater analysis, equity-rich means that the combined estimated amount of loan balances secured by those properties was no more than 50 percent of their estimated market values.

The report also states that just 3.1 percent of mortgaged homes, or one in 32, were considered seriously underwater in Q4 2021 – down from 3.4 percent of all U.S. homes with a mortgage in Q3 2021 and 5.4 percent, or one in 18 properties, in Q4 2020. The report notes that the combined estimated balance of loans secured by those properties was at least 25 percent more than the property’s estimated market value.

Also according to ATTOM’s latest analysis, across the country, 48 states saw equity-rich levels increase from Q3 2021 to Q4 2021, while seriously underwater percentages decreased in 46 states. The analysis found that year over year, equity-rich levels rose in 49 states, including the District of Columbia, as seriously underwater portions dropped in 48 states, including the District of Columbia.

ATTOM’s Q4 2021 report also revealed that the West and South had 13 of the 15 states where the equity-rich share of mortgaged homes rose most from Q3 2021 to Q4 2021. The report noted that states with the biggest increases included Tennessee, where the portion of mortgaged homes considered equity-rich rose from 41.4 percent in Q3 2021 to 47.2 percent in Q4 2021, North Carolina (up from 38.6 percent to 44.2 percent), Nevada (up from 44.9 percent to 49.8 percent), Georgia (up from 35.3 percent to 40.1 percent) and Arizona (up from 53.2 percent to 57.6 percent).

The report also mentioned that the highest levels of equity-rich properties around the U.S. remained in the West during Q4 2021, with nine of the top 10 states with the highest levels, including Idaho (66.7 percent of mortgaged homes were equity-rich), Vermont (64.8 percent), Utah (62.5 percent), Washington (58.6 percent) and Arizona (57.6 percent).

Getting even more granular, the Q4 2021 home equity and underwater analysis also found that among 8,651 U.S. zip codes that had at least 2,000 residential properties with mortgages in Q4 2021, there were 2,466 (29 percent) where at least half the mortgaged properties were equity-rich.

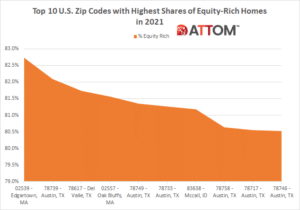

According to the report, 45 of the top 50 continued to be in California, Texas, Massachusetts and Idaho, with 13 of the top 25 in Austin, TX. Those zip codes included 02539 in Edgartown, MA (82.7 percent of mortgaged properties were equity-rich); 78739 in Austin, TX (82.1 percent); 78617 in Del Valle, TX (81.7 percent); 02557 in Oak Bluffs, MA (81.6 percent) and 78749 in Austin, TX (81.3 percent).

In this post, we uncover the complete list of the top 10 U.S. zip codes with the highest shares of equity-rich properties in Q4 2021. Those zips rounding out the top 10 include: 78733 – Austin, TX (81.3 percent of mortgaged properties were equity-rich; 83638 – Mccall, ID (81.2 percent); 78758 – Austin, TX (80.6 percent); 78717 – Austin, TX (80.5 percent); and 78746 – Austin, TX (80.5 percent).

ATTOM’S Q4 2021 U.S. Home Equity and Underwater report also stated that among 8,651 U.S. zip codes that had at least 2,000 homes with mortgages in Q4 2021, there were only 18 locations where more than 25 percent of mortgaged properties were seriously underwater, while four of the 18 were in Cleveland, OH.

Those top zip codes with the largest shares of seriously underwater properties in Q4 2021 included: 04330 in Augusta, ME (68.2 percent of mortgaged homes were seriously underwater); 44108 in Cleveland, OH (43.3 percent); 44112 in Cleveland, OH (39.6 percent); 10570 in Pleasantville, NY (38.6 percent) and 66441 in Junction City, KS (37.1 percent).

Want to see how your area fares in equity-rich or underwater properties share? Contact us to find out how!