According to ATTOM’s recently released Q2 2022 U.S. Home Sales Report, profit margins on median-priced single-family home and condo sales across the U.S. hit another new record of 55.5 percent following the largest quarterly gain in a decade.

ATTOM’s latest home sales analysis reported the latest typical profit margin – the percent change between median purchase and resale price – was up from 48.3 percent in Q1 2022 and 42.9 percent in Q2 2021 – more than 20 points above the 32 percent figure from Q2 2020.

The Q2 2022 report stated that typical profit margins increased from Q1 2022 to Q2 2022 in 89 percent of the 183 U.S. metro areas analyzed, while up annually in 95 percent. Metro areas were included if they had at least 1,000 single-family home and condo sales in Q2 2022 and a population of at least 200,000.

The report found the biggest annual increases in profit margins came in the metro areas of Fort Myers, FL (margin up from 47.1 percent in Q2 2021 to 90.9 percent in Q2 2022); Naples, FL (up from 40.4 percent to 83.1 percent); Ocala, FL (up from 44.4 percent to 85.2 percent); Gulfport, MS (up from a loss of 6.5 percent to a gain of 30.8 percent) and Yuma, AZ (up from 42.7 percent to 77.8 percent).

ATTOM’s latest sales report noted that gross profits also hit new highs in Q2 2022, after dipping slightly in the early months of the year. According to the report, the typical single-family home and condo sale across the country generated a gross second-quarter profit of $123,869 – up 19 percent from $103,750 in Q1 2022 and 38 percent from $90,000 in Q2 2021.

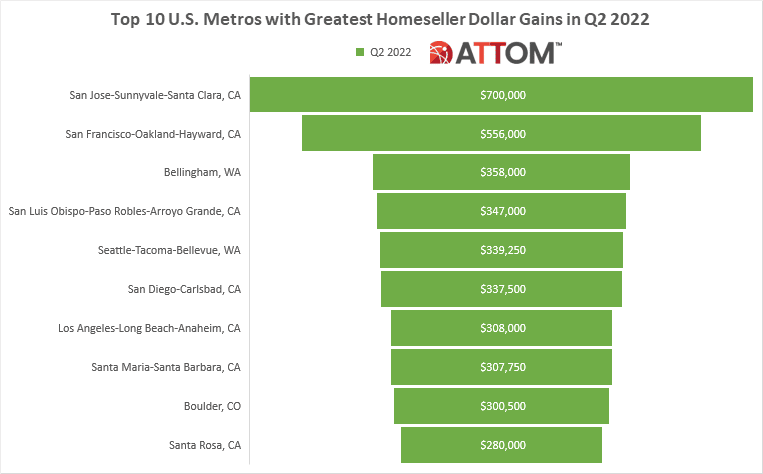

In this post, we dive deeper in the data behind the latest ATTOM home sales report to uncover those top U.S. housing markets saw the greatest gross profits in Q2 2022. Among those top metros with a population of 200,000 or more, those with greatest second-quarter dollar gains included: San Jose-Sunnyvale-Santa Clara, CA (gross profit of $700,000); San Francisco-Oakland-Hayward, CA (gross profit of $556,000); Bellingham, WA (gross profit of $358,000); San Luis Obispo-Paso Robles-Arroyo Grande, CA (gross profit of $347,000); Seattle-Tacoma-Bellevue, WA (gross profit of $339,250); San Diego-Carlsbad, CA (gross profit of $337,500); Los Angeles-Long Beach-Anaheim, CA (gross profit of $308,000); Santa Maria-Santa Barbara, CA (gross profit of $307,750); Boulder, CO (gross profit of $300,500); and Santa Rosa, CA (gross profit of $280,000).

ATTOM’s Q2 2022 home sales report noted the second-quarter records for gross profits and profit margins came as the national median home price hit a new high of $346,000 in Q2 2022 – the 10th straight quarterly increase. The latest median value was up 8.8 percent from Q1 2022 and 15.3 percent from Q2 2021.

The report also noted that nationwide, all-cash purchases accounted for 35.4 percent of all single-family home and condo sales in Q2 2022 – the highest level since Q1 2014. The Q2 2022 number was up from 34.6 percent in Q1 2022 and 31 percent in Q2 2021.

Want to learn more about home seller gains, sale prices and other home sale trends in your market? Contact us to find out how!