According to ATTOM’s just released 2022 Rental Affordability Report, home ownership remains more affordable than renting, even though median home prices have increased more than average rents and more than averages wages in 88 percent of U.S. counties analyzed.

ATTOM’s 2022 rental affordability report shows that owning a median-priced home is more affordable than the average rent on a three-bedroom property in 58 percent of the counties analyzed. The report noted that means major home ownership expenses consume a smaller portion of average local wages than renting.

The new report revealed the most populous counties where home prices are rising faster than rents. Those counties include Los Angeles County, CA; Cook County (Chicago), IL; Harris County (Houston), TX; Maricopa County (Phoenix), AZ and San Diego County, CA.

The 2022 rental affordability report also noted the largest counties where rents are rising faster than home prices. Those counties include Allegheny County (Pittsburgh), PA; Hidalgo County (McAllen), TX; Ventura County, CA (outside Los Angeles); Jackson County (Kansas City), MO and Lake County, IN (outside Chicago).

Also according to the new ATTOM analysis, renting is more affordable for average wage earners than buying a home in 21 of the nation’s 25 most populated counties and in 35 of 42 counties in the report with a population of 1 million or more. Those counties named in the report include Los Angeles County, CA; Cook County (Chicago), IL; Maricopa County (Phoenix), AZ; San Diego County, CA and Orange County, CA (outside Los Angeles).

ATTOM’s latest rental affordability report stated that other counties with a population of more than 1 million where it is more affordable to rent than to buy include locations in the Dallas, Miami, New York City, San Francisco, Washington, D.C., and Riverside, CA, metropolitan areas.

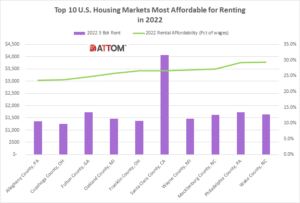

The report also notes that renting the typical three-bedroom property requires less than one-third of average local wages in 52 percent of counties analyzed. The analysis found the most affordable counties for renting among those with a population of at least 1 million include: Allegheny County (Pittsburgh), PA (23.7 percent of average local wages needed to rent); Cuyahoga County (Cleveland), OH (23.7 percent); Fulton County (Atlanta), GA (24.7 percent); Oakland County, MI (outside Detroit) (25.8 percent) and Franklin County (Columbus), OH (26.6 percent).

In this post, we dig deep into the data to uncover the complete list of the top 10 most populous counties where it’s most affordable to rent in 2022. Rounding out those top counties are: Santa Clara County, CA (26.6 percent of average local wages needed to rent); Wayne County, MI (27.0 percent); Mecklenburg County, NC (27.2 percent); Philadelphia County, PA (29.3 percent); and Wake County, NC (29.4 percent).

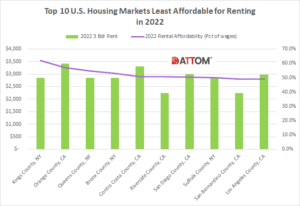

ATTOM’s 2022 rental affordability report also noted the least-affordable markets for renting among counties with a population of at least 1 million. Those counties named include Kings County (Brooklyn), NY (62 percent of average local wages needed to rent); Orange County, CA (outside Los Angeles) (57 percent); Queens County, NY (54.5 percent); Bronx County, NY (53.2 percent) and Contra Costa County, CA (outside San Francisco) (50.7 percent).

Also, in this post, we dig deep into the data to uncover the complete list of the top 10 most populous counties where it’s least affordable to rent in 2022. Rounding out those top counties are: Riverside County, CA (50.6 percent); San Diego County, CA (50.5 percent); Suffolk County, NY (50.2 percent); San Bernardino County, CA (49.2 percent); and Los Angeles County, CA (49.0 percent).

ATTOM’s 2022 rental affordability analysis incorporated recently released fair market rent data for 2022 from the U.S. Department of Housing and Urban Development, wage data from the Bureau of Labor Statistics along with public record sales deed data from ATTOM in 1,154 U.S. counties with sufficient single-family home sales data.

Want to learn more about rental affordability in your area? Contact us to find out how!