Just off the heels of ATTOM Data Solutions’ November 2019 U.S. Foreclosure Activity analysis released this week, which reveals the top states and metros with the highest foreclosure rates, this advance #FiguresFriday post dives deeper into the data to disclose where foreclosures are the most concentrated at the county level.

There were 49,898 U.S. properties with foreclosure filings in November 2019, down 10 percent from October 2019 and down 6 percent from a year ago, according to the latest ATTOM Data Solutions U.S. Foreclosure Activity Report.

The report noted that at the national level, one in every 2,713 U.S. properties had a foreclosure filing in November 2019. At the state level, those with the highest foreclosure rates in November were Delaware (one in every 1,112 housing units); New Jersey (one in every 1,278 housing units); Maryland (one in every 1,476 housing units); Illinois (one in every 1,535 housing units); and Florida (one in every 1,607 housing units).

Also included in the report, among the 220 metro areas with at least 200,000 people, those with the highest foreclosure rates in November were Buffalo, NY (one in every 798 housing units); Atlantic City, NJ (one in every 968 housing units); Columbia, SC (one in every 1,082 housing units); and Fayetteville, NC (one in every 1,134 housing units); and Trenton, NJ (on in every 1,146 housing units).

In the larger populated areas, 53 metro areas with at least 1 million people, those with the highest foreclosure rates in November already including Buffalo, NY were Jacksonville, FL (one in every 1,172 housing units); Cleveland, OH (one in every 1,279 housing units); Baltimore, MD (one in every 1,307 housing units); and Philadelphia, PA (one in every 1,343 housing units).

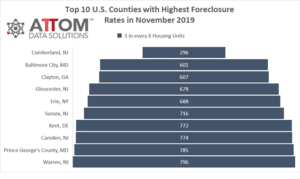

Closing in at the county level, New Jersey leads the pack with the highest concentration of counties in the top 10 with the highest foreclosure rates.

Among the counties with at least 100,000 people, here are the top 10 counties with the highest foreclosure rates in November 2019: Cumberland, NJ (one in every 296 housing units); Baltimore City, MD (one in every 601 housing units); Clayton, GA (one in every 607 housing units); Gloucester, NJ (one in every 678 housing units); Erie, NY (one in every 688 housing units); Sussex, NJ (one in every 716 housing units); Kent, DE (one in every 772 housing units); Camden, NJ (one in every 774 housing units); Prince George’s County, MD (one in every 785 housing units) and Warren, NJ (one in every 796 housing units).

ATTOM’s November 2019 foreclosure activity analysis also reported that bank repossessions were up four percent from the previous month, and up 22 percent from a year ago, while foreclosure starts were down 13 percent from the previous month, and down 11 percent from a year ago.

Want to discover what the foreclosure rate is in your area or if foreclosure activity is trending up or down in your town? Contact us to find out how!