ATTOM Data Solutions’ just released Midyear 2019 U.S. Foreclosure Market Report shows that foreclosure activity in the first six months of 2019 is down 18 percent from a year ago and down 82 percent from a peak in the first six months of 2010.

Counter to that trend, the report shows that 16 percent of the metro areas analyzed posted a year-over-year increase in foreclosure activity in the first six months of 2019, including Buffalo, New York (up 33 percent); Orlando, Florida (up 32 percent); Jacksonville, Florida (up 18 percent); Miami, Florida (up 7 percent); and Tampa-St. Petersburg, Florida (up 5 percent). If you are interested in learning more about our foreclosure statistics, click here.

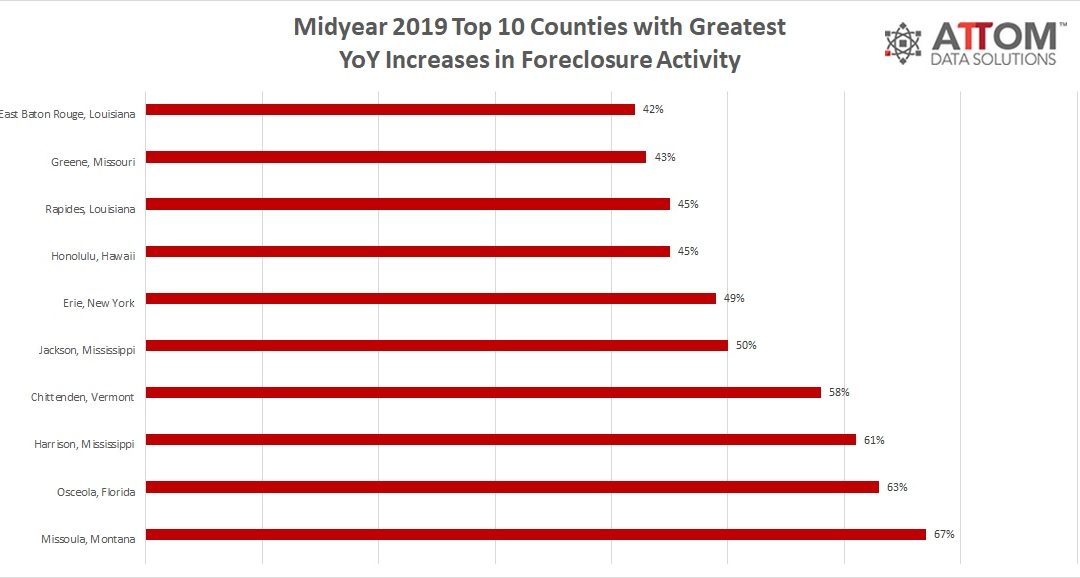

Top 10 Counties With Greatest YoY Increases in Foreclosure Activity

In drilling down further at the county level, here are the top ten counties (with a population of 100,000 or more) that posted the greatest year-over-year increases in foreclosure activity in the first six months of 2019:

Missoula, Montana (up 67 percent); Osceola, Florida (up 63 percent); Harrison, Mississippi (up 61 percent); Chittenden, Vermont (up 58 percent); Jackson, Mississippi (up 50 percent); Erie, New York (up 49 percent); Honolulu, Hawaii (up 45 percent); Rapides, Louisiana (up 45 percent); Greene, Missouri (up 43 percent); and East Baton Rouge, Louisiana (up 42 percent).

ATTOM’s midyear foreclosure report also shows that nationwide 0.22 percent of all housing units had a foreclosure filing in the first six months of 2019.

The metros with the highest foreclosure rates in the first half of 2019 were Atlantic City, New Jersey (0.92 percent of all housing units with a foreclosure filing); Jacksonville, Florida (0.54 percent); Trenton, New Jersey (0.52 percent); Rockford, Illinois (0.51 percent); and Lakeland, Florida (0.51 percent).

Top 10 Counties With Highest Foreclosure Rates

And at the county level? Here are the top ten counties (with a population of 100,000 or more) with the highest foreclosure rates in the first six months of 2019:

Cumberland, New Jersey (1.44 percent of all housing units with a foreclosure filing); Warren, New Jersey (1.06 percent); Sussex, New Jersey (0.95 percent); Gloucester, New Jersey (0.93 percent); Atlantic, New Jersey (0.92 percent); Camden, New Jersey (0.88 percent); Burlington, New Jersey (0.81 percent); Prince George’s County, Maryland (0.77 percent); Charles, Maryland (0.75 percent); and Ocean, Maryland (0.75 percent).

Want to see if foreclosure activity is trending up or down in your county, metro area or state? Or want to see how your local area ranks in terms of foreclosure rate?

Contact ATTOM now to find out how!