ATTOM Data Solutions recently released a special report spotlighting the U.S. housing markets more or less vulnerable to the impact of the Coronavirus pandemic. The analysis found that the Northeast has the largest concentration of the most at-risk counties, with clusters in New Jersey and Florida, while the West and Midwest have the smallest.

This special report will be the focus of an upcoming webinar scheduled for May 7, 2020, which will offer a detailed look into the data behind this analysis, and offer unique insights into why certain regions are more at risk, what this means for those distressed markets and how this will affect industry businesses/solution providers.

According to the ATTOM special report methodology, markets are considered more or less at risk based on the percentage of housing units receiving a foreclosure notice in Q4 2019, the percent of homes underwater (LTV 100 or greater) in Q4 2019, and the percentage of local wages required to pay for major home ownership expenses. The rankings are based on a combination of those three categories in 483 counties around the U.S. with sufficient data to analyze. Counties were ranked in each category, from lowest to highest, with the overall conclusions based on a combination of the three rankings.

The analysis revealed that housing markets in 14 of New Jersey’s 21 counties are among the 50 most vulnerable, including five in the New York City suburban area: Bergen, Essex, Passaic, Middlesex and Union counties. Another significant Northeast finding featured in the report was the New York counties among the top 50 most at risk include Rockland County, in the New York City metropolitan area; Orange County, in the Poughkeepsie metro area; Rensselaer County, in the Albany metro area; and Ulster County, west of Poughkeepsie.

ATTOM’s special report stated there are 10 counties in Florida contributing to a significant portion of the top 50 most vulnerable, including Flagler, Lake, Clay, Hernando and Osceola counties. The report also noted that other southern counties that landed in the top 50 are spread across Delaware, Maryland, North Carolina, South Carolina, Louisiana and Virginia.

Also according to analysis, among the counties analyzed, only two in the West and five in the Midwest (all in Illinois) rank among the top 50 most at risk from problems connected to the Coronavirus outbreak. The report named the two western counties including Shasta County, CA, in the Redding metropolitan statistical area and Navajo County, AZ, northeast of Phoenix. The midwestern counties named among the top 50 include McHenry County, IL; Kane County, IL; Will County, IL and Lake County, IL, all in the Chicago metro area; and Tazewell County, IL, in the Peoria metro area.

In this post, we unveil the complete lists of the top 10 county-level housing markets in both the West and Midwest, and where each rank in terms of more or less vulnerable to the impacts of COVID-19:

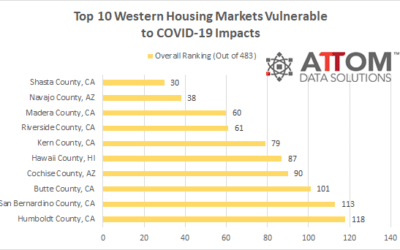

West

Out of the 483 U.S. counties included in the analysis, here are the top 10 western counties: Shasta County, CA (No. 30); Navajo County, AZ (No. 38); Madera County, CA (No. 60); Riverside County, CA (No. 61); Kern County, CA (No. 79); Hawaii County, HI (No. 87); Cochise County, AZ (No. 90); Butte County, CA (No. 101); San Bernardino County, CA (No. 113); and Humboldt County, CA (No. 118).

Midwest

Out of the 483 U.S. counties included in the analysis, here is the complete list of the top 10 midwestern counties: Mchenry County, IL (No. 4); Kane County, IL (No. 18); Will County, IL (No. 28); Tazewell County, IL (No. 34); Lake County, IL (No. 36); Saint Clair County, IL (No. 51); Cook County, IL (No. 53); Madison County, IL (No. 56); Winnebago County, IL (No. 63); and Peoria County, IL (No. 70).

Want to learn where your area ranks on this list? Contact us to find out how!