According to ATTOM Data Solutions’ newly released Q3 2020 Opportunity Zones Report, median home prices increased from Q3 2019 to Q3 2020 in 74 percent of qualified opportunity zones established by Congress in the Tax Cuts and Jobs act of 2017. For this report, ATTOM identified 1,737 zones with sufficient sales data to analyze, meaning those zones with at least five home sales in Q3 2020.

ATTOM’s most recent opportunity zones analysis also noted that median home prices rose by more than 10 percent in slightly more than half the designated zones. The report stated those gains revealed that housing markets in opportunity zones continued improving in Q3 2020, even as the Coronavirus pandemic further spread across the nation, impacting the U.S. economy and generally hitting hardest in lower-income communities where most of the zones targeted for tax breaks are located.

The Q3 2020 report also stated that those opportunity zone price gains fell below the pace of improvements in the broader metro areas throughout the country, while every metro with enough data to analyze in Q3 2020 showed year-over-year median price increases and three quarters of those areas saw prices jump more than 10 percent.

ATTOM’s new opportunity zones analysis also showed that 76 percent of the zones analyzed had median home prices in Q3 2020 that were less than the national median of $283,813 – roughly the same percentage that were below the national figure in Q3 2020. About 36 percent of the zones still had median prices of less than $150,000, also about the same as in Q2 2020.

Todd Teta, ATTOM’s Chief Product Officer, noted that, “Home prices in Opportunity Zones around the country continued rising in Q3 2020, riding the wave of a nationwide boom that has defied the economic damage from the widespread Coronavirus pandemic. The increases point toward signs that some of the country’s most distressed communities have great potential for revival. At that same time, though, prices remain depressed in Opportunity Zones, and a notable number actually dropped in the third quarter – a potentially very troubling indicator. Those dueling trends will be important to watch over the coming months amid a highly uncertain economic outlook.

The analysis reported the states with the largest percentage of zones with annual median price increases in Q3 2020 included Washington (median prices up in 88 percent of zones), Missouri (88 percent), Arizona (86 percent), Ohio (83 percent) and Rhode Island (82 percent).

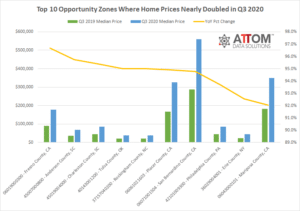

In this post, we dive deep into the data to determine where the top 10 opportunity zones are located that nearly doubled their home sales price from Q3 2019 to Q3 2020. Those zones included: 06019000300 – Fresno County, CA (price increased 96.7 percent); 45007000800 – Anderson County, SC (increased 95.7 percent); 45019004000 – Charleston County, SC (increased 95.4 percent); 40143001200 – Tulsa County, OK (increased 95.0 percent); 37157040200 – Rockingham County, NC (increased 95.0 percent); 06061021603 – Placer County, CA (increased 94.9 percent); 06071001504 – San Bernardino County, CA (increased 94.8 percent); 42101009300 – Philadelphia County, PA (increased 93.7 percent); 36029004001 – Erie County, NY (increased 92.6 percent); and 06043000101 – Mariposa County, CA (increased 92.0 percent).

ATTOM’s Q3 2020 opportunity zones report pointed out that of all 1,737 zones in the report, 36 percent had a median price in Q3 2020 that was less than $150,000, and 18 percent had medians ranging from $150,000 to $199,999. Another 22 percent ranged from $200,000 up to the national median price of $283,813, while 24 percent were more than $283,813.

The report also mentioned the Midwest continued to have the highest portion of Opportunity Zone tracts with a median home price of less than $150,000 (58 percent), followed by the South (48 percent), the Northeast (41 percent) and the West (8 percent).

Want to learn more about how opportunity zones are trending in your area? Contact us to find out how!