A Wealth of Property Insights at Your Fingertips

Access property data, real estate reports, automated valuation models, sales comps, market trends & analysis, homeowner contact info, and more. All in one easy-to-use solution.

Are you a real estate professional looking for individual access? Learn more

The Premier Source for Real Estate Data

ATTOM has been amassing real estate data and expertise for years—you can access it all in minutes.

155+ Million

U.S. Properties

99% Coverage

Across the Nation

3,000+

U.S. Counties

70+ Billion

Rows of Transactional- Level Data

- Land and Property Size

- Legal Description

- Interior Features

- Exterior Features

- Owner names and phone numbers

- Building Characteristics

- Flood Data

- School Districts

- External Improvements

- Taxes and Assessments

- Sales History

- Mortgage History

- Zoning

- Property Improvements

- Active Mortgages & Equity Analysis

- Property, Foreclosure, Pre-foreclosure, Sales, and Mortgage Search

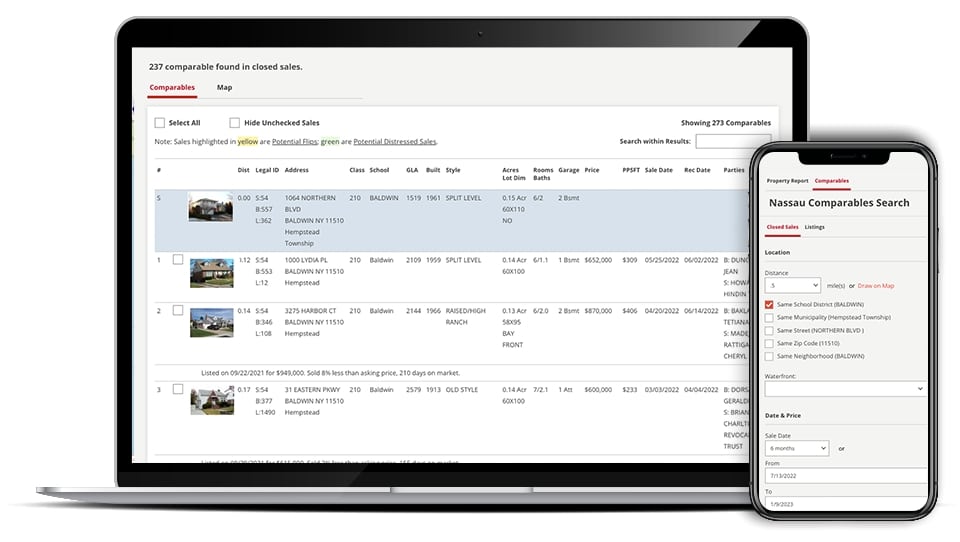

- Comparables & Market Analysis

How Property Navigator is Powering Various Industries

Gain that competitive edge and build a stronger portfolio.

Appraisal Management

Create home reports and get sales comps instantly.

Mortgage Lenders & Loan Originators

Ensure accurate appraisals and best loan terms.

Government & Agencies

Retrieve transactions and other valuable property data.

Real Estate Brokerages

Identify suitable comps and discover distressed property listings.

Multiple Listing Services (MLS)

Empower agents and brokerage teams to close more deals.

Financial Institutions

Access to on-demand valuations, property research, and equity analysis.

Corporate Relocators

Valuable neighborhood community and home information for employee relocations.

Asset Management Companies (AMC)

Comprehensive property portfolio research tools catered to teams of all sizes.

Tax Grievance Professionals

Target eligible homeowners and get detailed property data.

Property Navigator for Individual Real Estate Professionals

Produce accurate valuations and uncover valuable property details, owner information and more with instant access to Property Navigator — the industry’s leading solution for real estate search and property reports. Perfect for:

- Find Properties

With our powerful search and filtering capabilities, find the opportunities and leads you’re looking for.

- Assess and Evaluate

Gain insight and make data-driven decisions with a multitude of property details.

- Set Pricing Accurately

Fine-tune with up-to-date sales comps and robust automated valuation models.

What is a Property Report in Real Estate?

A property report is a collection of data that includes characteristics such as location; assessed value and tax information; property details such as the number of rooms, square footage; geographic and community information, such as local schools, amenities, and local demographics. Real estate professionals, buyers, sellers, mortgage lenders, investors, and lawyers use property reports as sources of information.

See How ATTOM Can Make a Difference for Your Business!

Have Questions about Property Navigator?

Please call 800-968-4079 — or fill out this form and we’ll be in touch shortly.