ATTOM Data Solutions’ new Q4 2020 U.S. Residential Property Mortgage Origination Report shows that 3.51 million mortgages secured by residential property (1 to 4 units) were originated in the U.S. in Q4 2020. According to the report, that figure was up 5.5 percent from Q3 2020 and 48 percent from Q4 2019, to the highest level in almost 14 years.

ATTOM’s most recent residential property mortgage origination analysis also showed that lenders issued $1.06 trillion worth of mortgages in Q4 2020. That number was up 6 percent from Q3 2020 and 55 percent from Q4 2019, to the largest quarterly amount since at least 2000. The report noted the quarterly rate of increase in loans and dollar volume represented the largest gains during any fourth-quarter period since 2011.

The Q4 2020 analysis also noted that the continued boost in mortgage lending activity came mostly from another jump in refinance mortgages, and the overall figure also was prompted by relatively strong home-purchase lending and home equity lines of credit.

The report revealed that lenders refinanced 2.23 million home mortgages in Q4 2020, which was 12 percent more than in Q3 2020 and 71 percent above Q4 2019. Also according to the report, the dollar amount of refinance loans rose to $666.8 billion, an 11 percent increase from Q3 2020 and a 67 percent increase from Q4 2019. Refinance loans comprised 63 percent of all home loans, up from 60 percent in Q3 2020 and 55 percent in Q4 2019.

ATTOM’s Q4 2020 mortgage origination analysis reported that refinance activity increased from Q3 to Q4 2020 in 88.3 percent of the metro areas included in the analysis. Among those metros with a population greater than 200,000 and at least 1,000 total loans, those with the largest quarterly increases were in Sioux Falls, SD (up 75.3 percent); Reno, NV (up 55.5 percent); Toledo, OH (up 55.1 percent); Lake Charles, LA (up 47.1 percent) and Chicago, IL (up 44 percent).

The report also stated that other than Chicago, among metro areas with at least 1 million people, those with the biggest increases in refinance activity from Q3 to Q4 2020 were Baltimore, MD (up 35.6 percent); San Jose, CA (up 27.5 percent); Tampa, FL (up 25.9 percent) and Indianapolis, IN (up 24.7 percent).

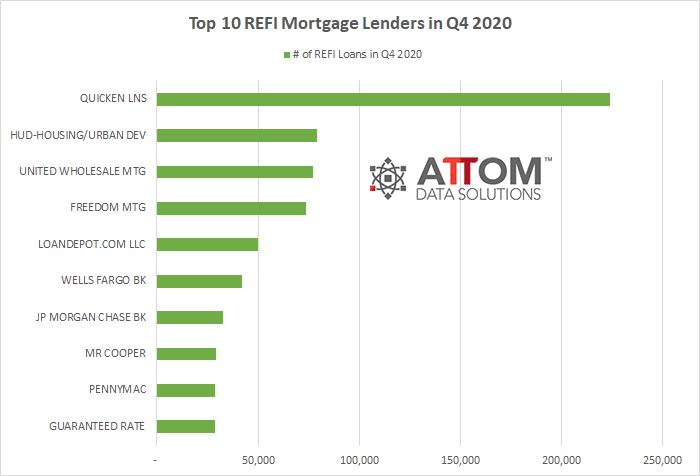

In this post, we take a deep dive into the data behind ATTOM’s Q4 2020 U.S. Residential Property Mortgage Origination Report to uncover the top 10 REFI mortgage lenders in Q4 2020. Those lenders include: QUICKEN LNS (223,689 REFI mortgages); HUD-HOUSING/URBAN DEV (79,314 REFI mortgages); UNITED WHOLESALE MTG (77,120 REFI mortgages); FREEDOM MTG (73,848 REFI mortgages); LOANDEPOT.COM LLC (49,760 REFI mortgages); WELLS FARGO BK (42,275 REFI mortgages); JP MORGAN CHASE BK (32,911 REFI mortgages); MR COOPER (29,172 REFI mortgages); PENNYMAC (28,728 REFI mortgages); and GUARANTEED RATE (28,577 REFI mortgages).

ATTOM’s Q4 2020 mortgage origination analysis also reported that the median down payment on single-family homes and condos purchased with financing in Q4 2020 was $24,500, up 19.2 percent from $20,556 in Q3 2020 and 82.3 percent from $13,441 in Q4 2019, marking another new high dating back to at least 2000. The report noted the median down payment of $24,500 represented 7.7 percent of the median sales price for homes purchased with financing during Q4 2020, up from 6.6 percent in Q3 2020 and from 5.2 percent in Q4 2019.

Want to learn more about home mortgage refinance or purchase activity in your market? Contact us to find out how!